Stablecoins in Payment Solutions: From Hype to the Cash Register

I still remember wiring money to a supplier in 2017 and watching the “estimated arrival: 2–5 business days” taunt me on the screen. Fees stacked, FX spreads bit me, and the bank’s cutoff time felt medieval. Fast forward to 2025: last month I paid a freelance dev in Bogotá with USDC on Base. He messaged back 12 seconds later: “Got it.” No waiting, no weekend penalty, no stomach-dropping surprise fee. That’s the promise of stablecoins in payments—digital dollars that actually move like the internet.

What are Stablecoins (really)?

Stablecoins are crypto tokens designed to track a reference value—usually the U.S. dollar—so you get crypto’s speed with fiat’s stability. The heavyweights in payments today are fiat-backed coins like USDT, USDC, and PYUSD, which hold cash and short-term Treasuries to maintain a 1:1 peg. They’re not moonshots; they’re rails.

• USDT and USDC dominate issuance and volumes

• PYUSD is pushing into consumer commerce via PayPal/Venmo

• Euro stablecoins are quietly gaining traction under EU rules

As of late June 2025, total stablecoin market cap hovered around a quarter-trillion dollars, with USDT near the mid-$150 billions and USDC in the low-$60s—climbing past $65B by mid-August. That’s not niche anymore.

Why stablecoin payments matter now

Three big shifts since 2024 turned payments from proof-of-concept into “okay, let’s ship this.”

1) Low-fee, high-throughput rails

• Solana transactions typically cost fractions of a cent and settle fast. For day-to-day commerce, that’s a game-changer. I’ve tested small-ticket USDC payments where fees were effectively invisible.

2) Mainstream onramps woke up

• Stripe brought back crypto payments, letting U.S. merchants accept USDC (and auto-settle to fiat). In June 2025, Stripe and Shopify announced a deeper partnership so millions of Shopify merchants can accept USDC on Base, with payouts in local currency by default. That’s real distribution.

• PayPal’s PYUSD went multichain to Solana in 2024—faster and cheaper transfers for mainstream users.

3) Regulatory clarity is arriving

• Europe’s MiCA stablecoin rules kicked in for “e-money tokens” on June 30, 2024, forcing transparency, licensing, and reserve quality.

• In the U.S., a new federal stablecoin law (the GENIUS Act) passed in August 2025, setting reserve and disclosure rules. It’s not the end of rulemaking—agencies still have to fill in details—but it’s a long-awaited baseline.

Where Stablecoins already win

• Cross-border payouts and remittances: The global average cost to send $200 remains around 6% in legacy rails. On the right networks, stablecoin transfers often land under a cent in network fees and arrive near-instantly. The delta is… not small.

• Merchant settlement: Visa has piloted USDC settlement with acquirers; Shopify and Stripe now make USDC checkout feel like any other payment method.

• Inflation hedging outside the U.S.: In places like Turkey or parts of LATAM, stablecoins function as “digital dollars” when local currency risk bites. Not an investment hedge—just a way to park value in USD terms without a U.S. bank account.

Anyway—none of this means “risk-free.” But the utility is finally loud.

The trader’s angle: cycles, halving, and payments momentum

Back in 2021, I watched BTC crater and learned (again) that crypto cycles are merciless. But here’s the kicker: payment adoption is less tethered to price than most narratives assume. The 2024 Bitcoin halving happened on April 19–20; we got the usual post-halving chop, ETFs soaked up headlines, and yet stablecoin payment rails kept compounding—because merchants and gig workers care about finality and fees, not block rewards.

Bitcoin halving history (for context)

Halving | Date | Block reward after | My quick read

—————————————-

1st | Nov 28, 2012 | 25 BTC | Birth of the “supply shock” meme.

2nd | Jul 9, 2016 | 12.5 BTC | Exchanges matured; payments still fringe.

3rd | May 11, 2020 | 6.25 BTC | DeFi summer; stablecoins exploded in trading.

4th | Apr 19–20, 2024 | 3.125 BTC | ETFs + real payment rails + regulatory frameworks.

How long do cycles last?

Roughly four years per halving epoch, but payment adoption isn’t gated by BTC’s price cycle. In my portfolio, stablecoin yield doesn’t rival bull-market alt runs, but operational utility (payouts, remits, hedging local inflation) is compounding regardless of “up only.”

How to actually use Stablecoins for payments (and not get wrecked)

I’ve made all the mistakes. Here’s the condensed playbook I wish I had in 2021.

• Pick the right chain for the job

• Solana: speed + sub-cent fees; great for retail-sized flows.

• Base: deep Coinbase/fiat connectivity; Shopify + Stripe support is a big deal.

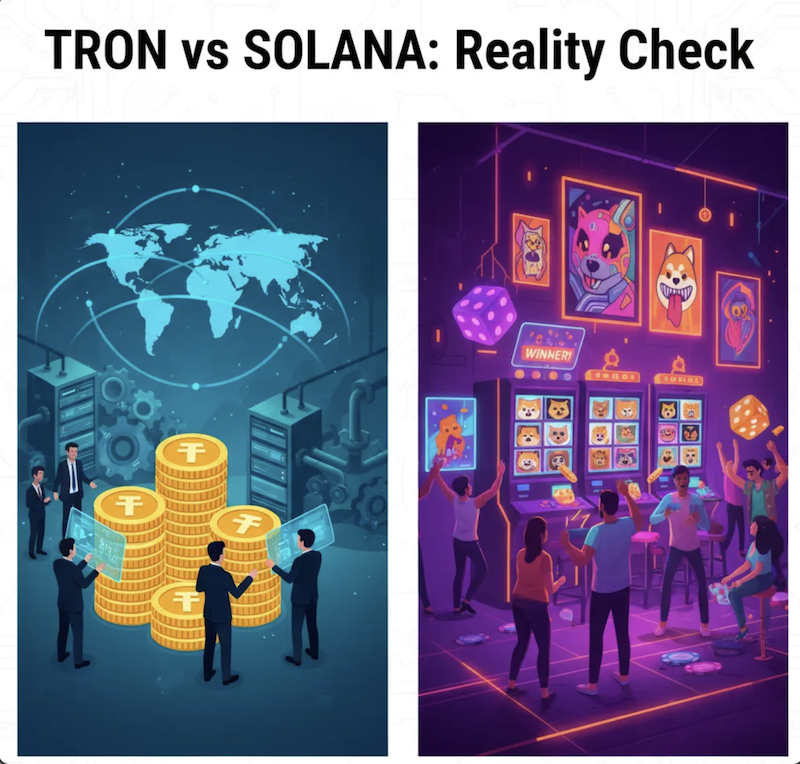

• Tron: huge USDT footprint in remittance-heavy corridors (mind compliance).

• Ethereum mainnet: settlement-grade but pricier; use L2s for day-to-day.

• Custody and counterparty hygiene

• Segregate hot wallets (ops) from cold storage (treasury).

• Use allowlists where possible; rotate keys quarterly.

• If you’re a business, map out who holds the reserves (issuer), who holds your coins (custodian), and who moves the money (processor).

• Choose issuers with transparent reserves

• Read the monthly attestations and composition of reserves (cash, T-bills).

• Understand redemption mechanics and any geographic limits.

• Automate compliance early

• KYC/KYB on on/off-ramps, set travel rule data-sharing, keep audit trails.

• If you serve EU users, understand MiCA obligations; in the U.S., watch the implementing rules under the new law.

• Quote in stablecoins, settle in local currency (or not)

• With Stripe/Shopify, you can price in USDC but receive fiat—clean for accounting.

• If you hold stables, reconcile daily and mark to $1; don’t pretend it’s an inflation hedge in USD terms.

• Fees and routing

• Batch payouts to reduce overhead.

• When possible, route on chains your counterparties already use to avoid extra bridge hops.

If you’re hedging inflation with stablecoins, here’s what I’d do:

• Keep runway in USDC/USDT on a low-fee chain for operating spend.

• Automate weekly off-ramp into local bills to minimize FX shocks.

• For large invoices, test a $5 transfer first to confirm address, chain, and memo tags. I’ve learned that one the hard way at 2 a.m.

Real-world examples I’ve watched up close

• Stripe turned USDC back on for online checkouts; countless dev tools and SaaS now offer “Pay with USDC” in the same flow as cards.

• Shopify’s USDC on Base is rolling out with fiat payouts by default—meaning a merchant in Austin or London can take a global crypto payment and reconcile it like a normal sale.

• PayPal moving PYUSD onto Solana was a tell: big consumer fintech wants low-fee settlement, period.

• Visa has been piloting USDC settlement with acquirers, reducing cross-border friction behind the scenes.

Not gonna lie, the first time I saw a weekend USDC payment hit instantly while my bank portal showed “processing Monday,” it felt like cheating.

Risks to respect (no rose-colored glasses)

• De-pegs happen: operationalize circuit-breakers—multiple stablecoins, multiple rails.

• Counterparty risk: issuers, custodians, processors. Diversify.

• Regulation by region: MiCA is live in the EU; the U.S. has a new federal framework but agency rules are still coming. Stay nimble.

• Chain risk: congestion, outages, MEV. Keep backup routes and SLAs where possible.

Where this goes next

Stablecoin volumes already dominate crypto trading, but 2024–2025 unlocked the commerce side: checkout buttons, payroll APIs, and settlement inside existing payment stacks. As regulatory clarity firms up and mainstream processors abstract the crypto-complexity, stablecoin payments feel less “crypto” and more… internet money.

I’ve traded through blow-offs and bear winters. Payments aren’t trying to 10x in a week. They’re trying to not break on a Saturday. That’s a better north star for the next cycle.

Bottom line

Stablecoins have graduated from trader tool to business rail. They cut fees, crush settlement times, and—thanks to Shopify, Stripe, PayPal, and Visa—now show up where real buyers are. If you’re a founder, CFO, or solo operator, start with one clean use case: cross-border invoice, remittance program, or checkout add-on. Then measure the savings.

That’s why I lean on tools like vtrader.io to route stablecoin flows, check on-chain fees, and keep my ops boring—in the best possible way.

Sources:

• https://data.coindesk.com/reports/stablecoins-cbdcs-report-june-2025

• https://research.kaiko.com/insights/usdc-outpaces-rivals

• https://www.investopedia.com/circle-internet-group-stock-jumps-as-usdc-stablecoin-circulation-soars-11789372

• https://newsroom.paypal-corp.com/2024-05-29-PayPal-USD-Stablecoin-Now-Available-on-Solana-Blockchain%2C-Providing-Faster%2C-Cheaper-Transactions-for-Consumers/

• https://stripe.com/newsroom/news/shopify-stripe-stablecoin-payments

• https://help.shopify.com/en/manual/payments/shopify-payments/usdc-payments

• https://usa.visa.com/about-visa/newsroom/press-releases.releaseId.19881.html

• https://finance.ec.europa.eu/news/digital-finance-2024-12-19_en

• https://www.reuters.com/legal/government/companies-plan-stablecoins-under-new-law-experts-say-2025-08-12/

• https://solana.com/learn/understanding-solana-transaction-fees

• https://www.worldbank.org/en/news/press-release/2024/06/26/remittances-slowed-in-2023-expected-to-grow-faster-in-2024

• https://charts.bitbo.io/halving-dates/

Steve Gregory is a lawyer in the United States who specializes in licensing for cryptocurrency companies and products. Steve began his career as an attorney in 2015 but made the switch to working in cryptocurrency full time shortly after joining the original team at Gemini Trust Company, an early cryptocurrency exchange based in New York City. Steve then joined CEX.io and was able to launch their regulated US-based cryptocurrency. Steve then went on to become the CEO at currency.com when he ran for four years and was able to lead currency.com to being fully acquired in 2025.