When you hear people talk about a cryptocurrency, what's the first number they usually mention? Most of the time, it’s the price. But focusing only on price can be a classic rookie mistake.

The real metric you want to look at is the market capitalization, or "market cap." In simple terms, this is the total value of all the coins or tokens currently out there for a particular crypto. Think of it as the most honest way to gauge a project's true size and influence in the market.

Gearing Up With The Right Metric

A low coin price might look like a great bargain, but on its own, it tells you almost nothing about the project's overall value. This is where market cap cuts through the noise and gives you a much clearer picture.

The calculation itself is incredibly simple:

Market Cap = Current Price × Circulating Supply

Let's break that down with a quick example. Imagine you have Crypto A, which is trading at $100 per coin, and there are 1 million coins in circulation. Its market cap is a respectable $100 million.

Now, let's look at Crypto B. It's only trading for $2 per coin, which seems cheap. But, it has 200 million coins in circulation. Do the math, and you'll find its market cap is a whopping $400 million.

Despite its tiny price tag, Crypto B is actually four times larger and more significant than Crypto A. That’s a huge difference, and it’s the kind of insight that market cap provides instantly.

To help you get a firm grip on this concept, here's a quick summary table.

Market Cap At A Glance

This table breaks down the essential components of market capitalization, explaining what each part represents and why it's so important for any crypto trader or investor.

| Component | What It Represents | Why It Matters |

|---|---|---|

| Market Cap | The total value of a cryptocurrency's circulating coins. | Provides a true measure of a crypto's size and market dominance. |

| Current Price | The price of a single coin or token at a given moment. | A key factor in the market cap formula, but misleading on its own. |

| Circulating Supply | The number of coins that are publicly available and in circulation. | Determines how the price translates into the project's total value. |

Understanding these pieces is the first step toward making smarter, more informed decisions in the fast-paced world of crypto.

Grasping this fundamental difference is crucial. It allows you to accurately compare different assets and understand their standing in the wider crypto ecosystem. If you're looking to build up more of this foundational knowledge, the vTrader Academy is packed with resources to get you up to speed.

How Crypto Market Cap Is Actually Calculated

When you peel back the layers, the formula for a crypto's market cap is surprisingly simple. But don't let that fool you—understanding what goes into that calculation is where the real insight comes from.

It’s a straightforward multiplication, but the story is in the numbers.

The first part of the equation is the Current Price. That one’s easy. It’s the price tag you see on a single coin or token when you check your favorite exchange. This number is constantly shifting, driven by the raw forces of supply and demand across the globe.

The second piece is the Circulating Supply, and this is where things get a lot more interesting. This isn't just the total number of coins that exist; it's the number of coins that are actually out in the wild, available for you and me to trade. This figure is absolutely vital for an accurate valuation.

Circulating Supply Versus Total Supply

It's easy to get these terms mixed up, but the difference is critical if you want a real-world picture of a project's value.

- Circulating Supply: These are the coins in public hands right now. This is the magic number used for calculating market cap.

- Total Supply: This includes every coin ever created, minus any that have been verifiably burned (aka destroyed). It can include locked-up coins not yet available to the public.

- Max Supply: This is the absolute, hard-coded limit on the number of coins that will ever exist. Bitcoin, for example, is capped at 21 million coins. That's it.

Market capitalization is essentially the total current value of a crypto asset. When you hear about Bitcoin's market cap, it’s the combined value of all bitcoins currently in circulation. These numbers are anything but static. For instance, the total crypto market cap hit a peak of around $3.8 trillion in early 2025 before tumbling 18.6% to $2.8 trillion in the first quarter—a stark reminder of the market’s volatility. You can dig into the specifics in this 2025 Q1 Crypto Report.

By focusing on the circulating supply, we get the most realistic snapshot of a cryptocurrency's current value. It strips out all the noise from locked or unmined coins that could otherwise paint a misleadingly large picture, giving us a much truer sense of a project's size and footprint in the market today.

Why Market Cap Is a Vital Tool for Investors

Knowing how to calculate market cap is one thing, but understanding why it's a game-changer is what truly sets seasoned investors apart. Think of market cap as your compass in the wild, often choppy seas of the crypto market—it helps you get a real feel for a coin's relative size, stability, and overall risk profile.

It’s a concept borrowed straight from the stock market. A large-cap crypto, like Bitcoin or Ethereum, is the equivalent of a blue-chip stock like Apple or Amazon. These are the established giants. They’ve been around the block, have massive networks, and tend to be less volatile than the new kid on the corner. For many, they’re the bedrock of a crypto portfolio.

On the flip side, you have the small-cap cryptos. These are the scrappy startups of the digital asset world. They carry a much higher risk, no doubt, but they also hold the potential for the kind of explosive, 100x growth that the big players have likely already seen.

A Truer Measure of Value

One of the biggest traps for new investors is getting fixated on the price of a single coin. But a high price tag can be seriously misleading if you don't factor in the total supply. This is where market cap cuts through the noise and gives you a much clearer picture of a project's actual scale.

Let's look at two imaginary projects to see this in action:

- Crypto X: Price = $500, Circulating Supply = 1 million coins

- Market Cap = $500 million

- Crypto Y: Price = $2, Circulating Supply = 500 million coins

- Market Cap = $1 billion

Even though Crypto X’s price is 250 times higher, its market value is actually half that of Crypto Y. Crypto Y is, by far, the bigger project. This simple comparison hammers home why getting a grip on what is market cap in crypto is non-negotiable for making smart moves.

Market cap is the great equalizer. It lets you compare apples to apples, revealing a project's true economic footprint so you aren't fooled by a deceptively high coin price.

At the end of the day, using this metric helps you build a more intelligent and balanced portfolio. By digging into a coin’s market capitalization, you can make sure your investment choices actually line up with your personal risk tolerance and financial goals. To see how these concepts play out in real-time, you can check out the latest crypto market news on vTrader's platform for timely analysis and insights.

Navigating the Different Tiers of Market Cap

The crypto world isn't one big, monolithic market. It’s a sprawling ecosystem filled with projects of every imaginable size, and market cap is our map to navigate it all. We generally group cryptocurrencies into three main tiers, and knowing the difference is crucial for matching your strategy to your risk tolerance.

Think of it just like the stock market. You've got the established industry titans, the promising mid-sized companies, and the high-risk, high-reward startups. Each category comes with a completely different set of expectations.

Large-Cap Cryptocurrencies

Often called the "blue-chips" of crypto, large-cap projects are those with a market cap of $10 billion or more. These are the household names—think Bitcoin and Ethereum. They generally offer more stability and have deep liquidity, which means you can buy and sell large amounts without causing wild price swings.

While they probably won’t deliver the explosive, overnight gains of smaller projects, they are widely considered the bedrock assets for a diversified crypto portfolio.

Mid-Cap and Small-Cap Cryptocurrencies

Mid-cap cryptocurrencies are typically in the $1 billion to $10 billion range. These projects have already proven themselves to some degree but still have plenty of room to grow. They represent a middle ground, offering a shot at higher returns than the large-caps but bringing more risk to the table.

Then you have the small-caps, with valuations under $1 billion. This is the most volatile and speculative corner of the market. These are often newer projects with brilliant—but unproven—ideas. They carry the highest risk of failure, but they also hold the potential for truly life-changing gains, making them a classic high-risk, high-reward play. Analyzing trading activity is critical here; you can check out various pairs and their trading fees on vTrader.

By August 2025, the top 10 cryptocurrencies collectively soared past $2 trillion in market cap. Bitcoin and Ethereum alone made up nearly 75% of that staggering figure, showing just how much value is concentrated at the very top.

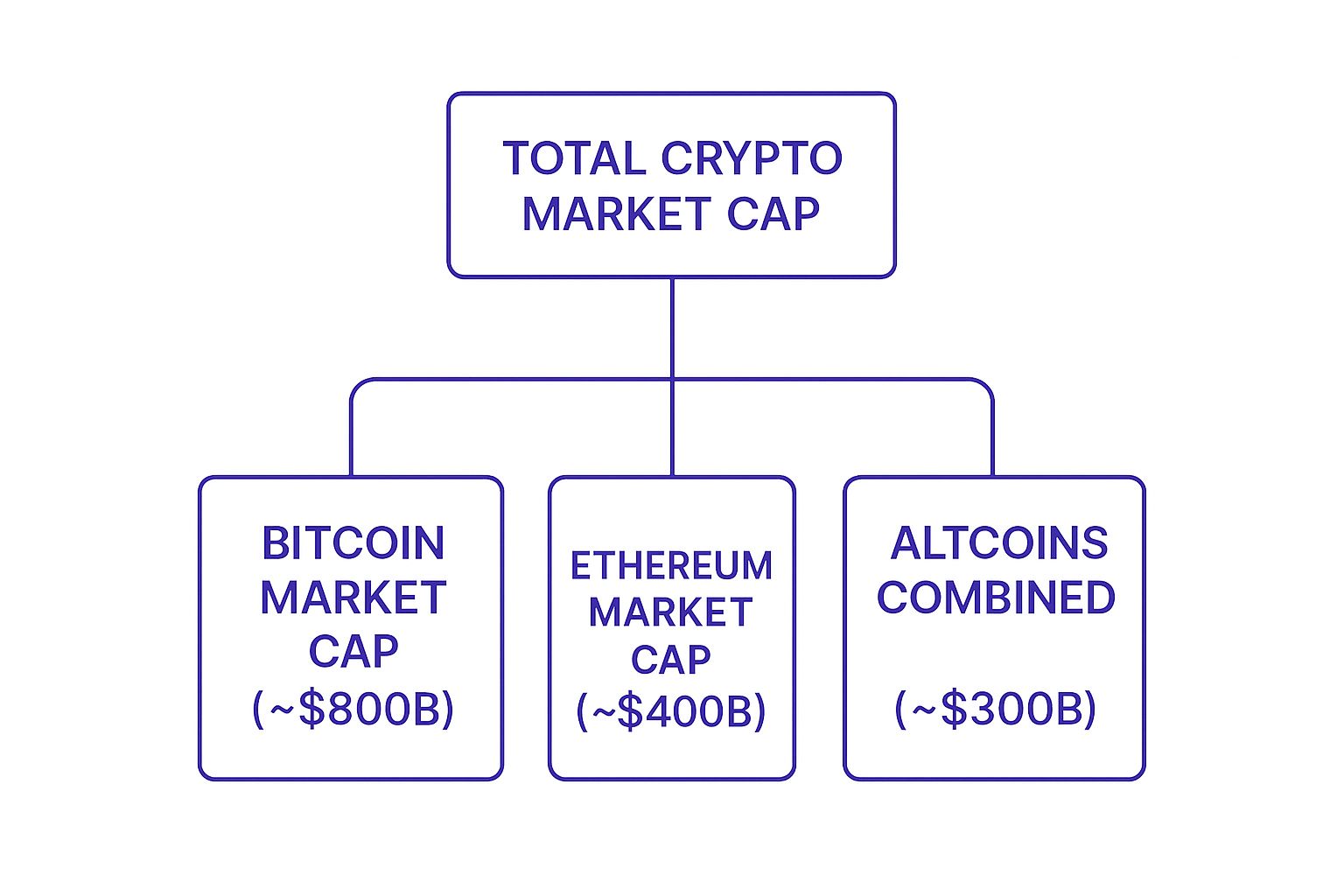

The infographic below really puts the distribution of the total crypto market cap into perspective.

This visual drives home the immense scale of Bitcoin and Ethereum compared to the thousands of other altcoins combined.

Crypto Market Cap Tiers Compared

To make things clearer, let’s break down what you can generally expect from each market cap tier.

| Tier | Market Cap Range | Characteristics | Risk Profile |

|---|---|---|---|

| Large-Cap | Over $10 Billion | Established, high liquidity, more stable, well-known | Lower |

| Mid-Cap | $1 Billion – $10 Billion | Proven use case, significant growth potential, moderate volatility | Medium |

| Small-Cap | Under $1 Billion | New or niche, unproven tech, high growth potential, very volatile | High |

Ultimately, understanding these tiers helps you build a more intentional portfolio. Whether you're aiming for stability with the giants or chasing massive growth with the up-and-comers, market cap is the first filter you should apply.

Common Market Cap Pitfalls and Misconceptions

While market cap is a go-to metric, it’s far from the whole story. One of the biggest mistakes a crypto investor can make is treating it as the single source of truth for a project's value. To use it wisely, you have to get familiar with its limitations and the myths that swirl around it.

A smart investor knows that even the best tools have blind spots.

Perhaps the most persistent myth is that market cap equals the total amount of money poured into a project. That’s just not true. Market cap is a theoretical number—a snapshot based on the last traded price multiplied by the circulating supply. It's not a bank account holding billions of dollars.

Think about it: if a major holder decided to sell off a huge chunk of a low-liquidity coin, the price would plummet. The market cap would collapse right along with it, showing that the actual "money in" was never close to that lofty figure.

The Problem of Liquidity and Manipulation

A high market cap can create a dangerous illusion of safety, especially if a project doesn’t have the trading volume to back it up. Liquidity is all about how easily you can buy or sell an asset without tanking the price. A crypto might boast a $500 million market cap on paper, but if its daily trading volume is a measly $50,000, that’s a massive red flag.

A project with a huge market cap but thin trading volume is like a mansion built on a swamp. It looks impressive from a distance, but the foundation is dangerously weak and could sink at any moment.

This lack of real trading activity makes a project a prime target for manipulation. Just a few large trades can artificially pump up the price and, by extension, the market cap. It’s a classic trap, and it’s why you have to dig deeper.

Here are a few other critical details market cap tells you nothing about:

- Technological Innovation: Is the project's code actually being developed and improved?

- Community Strength: Is there a real, vibrant community backing the project, or just a lot of hype?

- Trading Volume: How much is actually being bought and sold every day?

- Token Distribution: Are all the tokens concentrated in the hands of a few "whales" who could dump on the market at any time?

Understanding what is market cap in crypto means accepting it for what it is: a quick estimate of size. It should be the starting point of your research, not the finish line.

Putting Market Cap to Work on vTrader

It’s one thing to know what market cap is, but the real magic happens when you use it to make smarter trades. On vTrader, you can turn this knowledge into a powerful strategy for sniffing out opportunities and getting a feel for the market’s overall health.

The platform makes it incredibly easy to filter and sort cryptocurrencies by their market capitalization. This lets you slice up the market however you see fit. For instance, you can zero in on the large-cap giants for more stability or dive into the small-cap pool to hunt for higher growth potential—all with just a few clicks. It’s a simple way to match potential investments with your personal risk appetite.

Spotting Opportunities on the Platform

Once you pull up the main market view on vTrader, you'll see a clean, sortable list of every available asset.

As you can see, you can rank coins from the biggest to the smallest market cap, which instantly puts established heavyweights like Bitcoin and Ethereum right at the top. This view is perfect for a quick, at-a-glance comparison of different projects' relative sizes.

When you use market cap as your main filter, you cut through the noise of daily price swings and get right to a project's true economic weight. It's a game-changing first step in your research.

vTrader also gives you a chart of the total crypto market cap. Keeping an eye on this chart is like taking the pulse of the entire market. A rising total market cap often signals a bullish mood is taking over, while a downturn might suggest a bearish trend is setting in. And for those looking to generate returns no matter which way the market is heading, you can always explore options like crypto staking on vTrader to put your holdings to work.

Frequently Asked Questions About Crypto Market Cap

Even after you get the hang of it, market cap has a few tricky corners. Let's dig into some of the most common questions to sharpen your skills and help you read the market with more confidence.

Market Cap vs Fully Diluted Valuation

One of the biggest points of confusion is the difference between market cap and Fully Diluted Valuation (FDV). While market cap only counts the coins currently in circulation, FDV gives you a glimpse into a project's potential value if every single token—including locked ones—were on the market today.

FDV = Current Price × Max Supply

A huge gap between a coin's market cap and its FDV can be a major red flag. It often means a flood of new tokens could hit the market down the road, potentially watering down the value for everyone already holding.

Impact of Total Market Cap

Think of the total crypto market cap—the combined value of all cryptocurrencies—as a broad health report for the entire industry. When it's climbing, it signals bullish sentiment that tends to lift most coins with it. But when it drops, it usually drags the majority of assets down in a bearish wave.

Can a Market Cap Go to Zero?

Absolutely. If a project fails, gets abandoned by its developers, or is exposed as a scam, its price can crash all the way to nothing. And when the price hits zero, so does the market cap, wiping out its value completely.

If you have more questions, you can find detailed explanations in our complete vTrader FAQ section.

Ready to put this knowledge to the test? On vTrader, you can sort, analyze, and trade hundreds of assets using market cap data—all with zero commission fees. Start trading for free today

Steve Gregory is a lawyer in the United States who specializes in licensing for cryptocurrency companies and products. Steve began his career as an attorney in 2015 but made the switch to working in cryptocurrency full time shortly after joining the original team at Gemini Trust Company, an early cryptocurrency exchange based in New York City. Steve then joined CEX.io and was able to launch their regulated US-based cryptocurrency. Steve then went on to become the CEO at currency.com when he ran for four years and was able to lead currency.com to being fully acquired in 2025.