Trading crypto without paying fees isn't just a gimmick—it's a real strategy if you know where to look. It’s less about finding a single magic platform and more about understanding how exchanges make their money. By doing so, you can use promotional offers, specific order types, and platforms like vTrader—which built its entire model around zero-commission trading—to your advantage.

Is Fee-Free Crypto Trading Actually Possible?

A lot of traders just assume fees are a non-negotiable cost of doing business in crypto. While that's often true on the big-name exchanges, a new wave of platforms is shaking things up. The idea of trading crypto without fees isn't some myth; it’s a reality born from intense competition and clever business models.

So, how do these exchanges keep the lights on? It really boils down to a few key approaches:

- Promotional Offers: Exchanges frequently run temporary zero-fee events to grab new users and spike their trading volume.

- The Bid-Ask Spread: Instead of a direct commission, some platforms earn their cut from the tiny price difference between what buyers are willing to pay (the bid) and what sellers are asking for (the ask).

- Incentivizing Liquidity: Platforms often give traders who place limit orders (known as "makers") a break with lower or even zero fees. Why? Because those orders add much-needed stability and depth to the market.

The Rise of Promotional Zero-Fee Trading

This fierce competition has created some incredible opportunities for traders who are paying attention. Exchanges are now using zero-fee promotions as a major weapon to steal market share. We've seen platforms like MEXC and WOO X offer zero trading fees on most, if not all, of their spot trading pairs for long stretches. Deribit has done something similar, dropping fees on major pairs like BTC/USDC to pull in more volume.

For high-frequency traders, these promotions are gold. Even a fraction of a percent in fees can chew through profits when you're making dozens or hundreds of trades.

The real trick is knowing that most of these zero-fee deals are temporary. A smart trader stays in the loop and is ready to pounce when these windows of opportunity open, letting them lock in gains while keeping costs at zero.

To make this work, you have to stay on top of the latest news. By keeping an eye on platform announcements and general market trends, you can strategically move your funds to capitalize on these cost-saving periods. A great place to start is by checking the latest crypto market news for platform updates and new opportunities. This turns fee avoidance from a passive wish into an active, profitable part of your trading strategy.

To make it even clearer, let's break down the main ways you can approach fee-free trading.

Key Strategies for Fee-Free Crypto Trading

Here's a quick summary of the primary methods traders use to trade crypto with zero or minimal fees, and who each strategy is best suited for.

| Strategy | How It Works | Best For |

|---|---|---|

| Promotional Campaigns | Exchanges waive fees temporarily to attract users and boost volume on specific pairs or across the entire platform. | Active traders who can quickly move funds to capitalize on short-term offers. |

| Maker-Taker Model | Placing "maker" orders (limit orders that don't fill immediately) often comes with zero or very low fees to add liquidity. | Patient traders who are willing to set a price and wait, rather than buying at the current market price. |

| Zero-Commission Platforms | Platforms like vTrader build their business model around not charging direct trading fees, often earning on the bid-ask spread instead. | Traders of all levels who want a consistent, predictable fee-free experience without chasing promotions. |

By combining these strategies, you can significantly reduce or even eliminate your trading costs, giving you a serious edge and boosting your overall profitability.

Understanding How Crypto Exchange Fees Work

Before you can really start dodging crypto fees, you have to get a handle on what they are and how they actually work. For many traders, these costs are just a number that disappears from their balance. But they have names, purposes, and, most importantly, weaknesses you can use to your advantage. Think of it like a game—you can’t win if you don't know the rules.

The most common culprit you'll run into are trading fees. These are the small cuts an exchange takes every time you buy or sell. Usually, they're a tiny percentage of your trade's total value. A 0.10% fee on a $1,000 trade, for example, will set you back $1.00. It sounds small, but for anyone trading regularly, those dollars add up fast and can quietly eat away at your profits.

The Maker Versus Taker Model

Most traditional exchanges run on a maker-taker fee model. This whole system is set up to encourage traders to provide liquidity, which is the absolute lifeblood of any healthy market. Getting the hang of this distinction is your first real step toward trading crypto without fees, or at least with much lower ones.

Here’s a simple breakdown of how it works:

- Makers: You’re a "maker" when you place an order that doesn’t fill right away, like a limit order to buy Bitcoin below its current price. That order sits on the exchange's order book, literally "making" a market. Exchanges love this and reward makers with lower fees.

- Takers: You become a "taker" when you place an order that executes instantly at the going market price—think market orders. This action "takes" liquidity off the order book. Since you’re removing available orders, you’ll almost always pay a higher fee.

Simply by switching from market orders to limit orders, you flip the script from being a taker to a maker. It’s one of the easiest and most powerful ways to slash your trading costs on nearly any platform.

Beyond the Trade: The Other Fees to Watch

Trading fees get all the headlines, but they aren't the only costs you need to keep an eye on. Exchanges have other ways to charge you, and knowing what they are is key to a solid cost-saving strategy. The other big ones are withdrawal and network fees.

Withdrawal fees are flat charges for moving your crypto off an exchange and into a personal wallet. These can be all over the map, varying wildly between platforms and even between different coins on the same exchange.

Then you have network fees (or "gas fees" on networks like Ethereum), which are paid to the blockchain validators who process your transaction. The exchange doesn't set these, but how their system calculates and applies them can definitely affect your final cost. Platforms like vTrader cut through the noise by offering a clear, transparent structure. You can dive into the specifics by checking out the detailed vTrader fee schedule. Knowing these details ahead of time helps you plan your moves and avoid any nasty surprises.

Finding the Best Low-Fee Crypto Exchanges

Your quest to trade crypto without fees really starts with picking the right place to play. It's the single most important decision you'll make, because not all exchanges see costs the same way. Some view fees as their main money-maker, while others dangle low-cost structures to pull in high-volume traders and boost liquidity.

You’ve got to look past the flashy marketing and dig into the actual fee schedules. The big exchanges often roll out the red carpet for traders who bring in serious volume, sometimes slashing fees down to zero for their top users. This tiered system is pretty standard, and it gives you a clear roadmap to cutting costs as your trading ramps up.

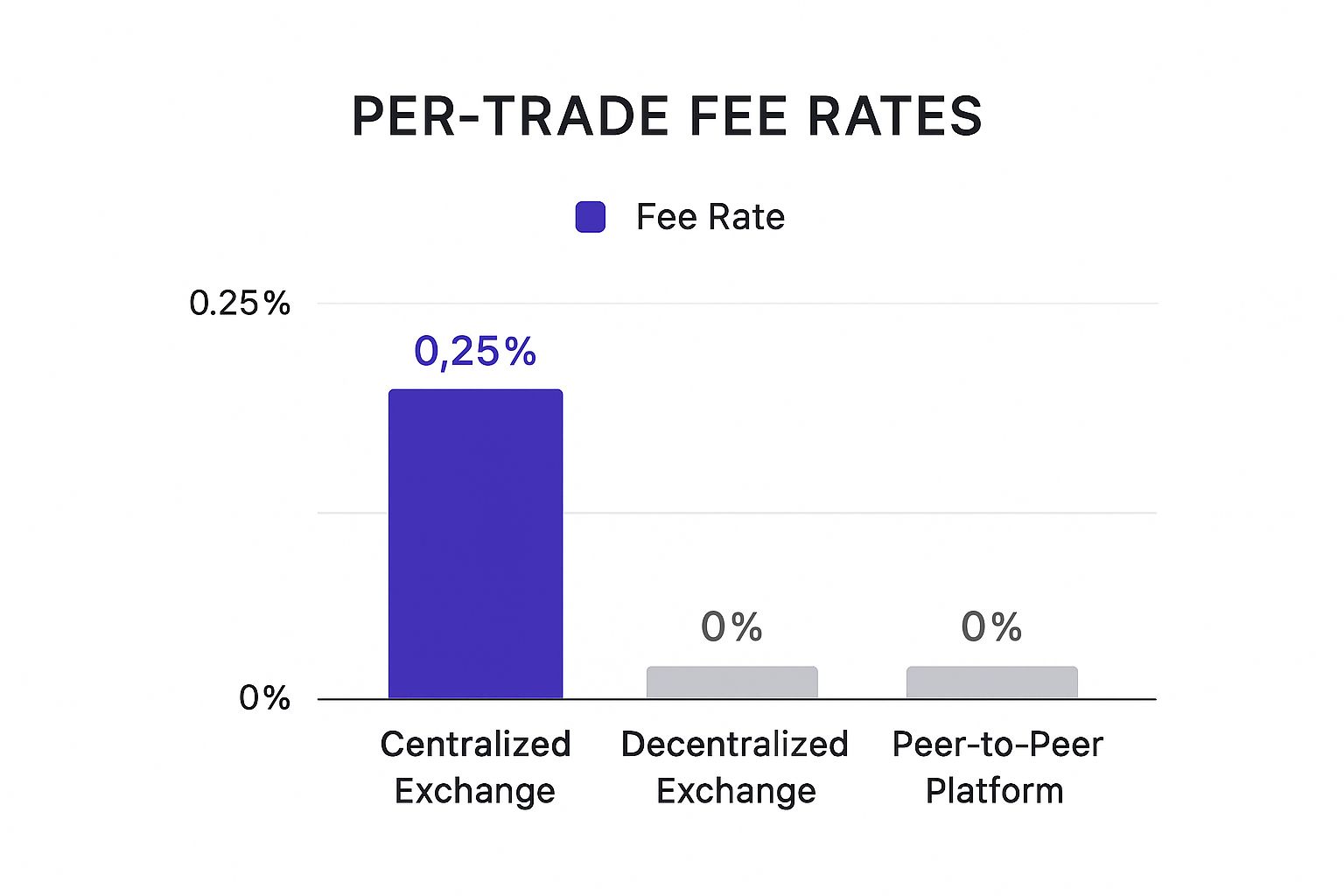

This chart really puts the fee differences between platform types into perspective.

As you can see, decentralized and peer-to-peer platforms often have a built-in advantage if your goal is getting as close to zero-fee trading as possible.

Comparing Centralized Exchange Fee Models

Heavy hitters in the US market take wildly different approaches to fees. Take Binance.US, for example—it's known for a low 0.10% flat trading fee and even dangles zero-fee trading on specific Bitcoin pairs. Then there's Robinhood Crypto, famous for having no direct commissions. But the catch is they make their money on the bid-ask spread, which usually sits between 0.3% and 0.4%. It's an indirect cost, meaning you buy a little higher and sell a little lower.

If you're looking to branch out your strategies, diving into a full guide on Binance Futures trading can shed light on its specific fee structures and how it all works.

Other major players like Kraken Pro and Coinbase Advanced use volume-based tiers. On Kraken Pro, maker fees can plummet to 0% if you’re trading over $10 million a month. Coinbase Advanced does something similar, offering maker rebates at high volumes, which means they're literally paying you to provide liquidity. Bitstamp has an interesting angle, too—it charges zero fees for anyone trading under $1,000 a month, making it a great entry point for new traders.

The Trade-Off With Commission-Free Platforms

Platforms shouting "commission-free" from the rooftops, like Robinhood, sound incredibly simple and appealing. And they are, but it's vital to understand the trade-off. You won't see a fee line item on your statement, but the wider bid-ask spread is a hidden cost baked right into the price.

For frequent traders or those moving large amounts, that spread can easily end up costing you more than a straightforward, low-percentage fee on another exchange.

To help you sort through it all, I've put together a quick comparison of how these fee structures really stack up.

Comparison of Low-Fee Crypto Exchanges

When you're trying to minimize costs, it's not just about the advertised rate. The table below breaks down the fee models for some of the top exchanges, highlighting how they reward different types of traders.

| Exchange | Maker Fee Range | Taker Fee Range | Key Feature for Low Fees |

|---|---|---|---|

| Binance.US | 0.00% – 0.10% | 0.00% – 0.10% | Zero fees on select BTC pairs and low flat fees for other assets. |

| Kraken Pro | 0.00% – 0.16% | 0.10% – 0.26% | Fee rebates and 0% maker fees for very high-volume traders. |

| Bitstamp | 0.00% – 0.40% | 0.00% – 0.40% | Zero fees for monthly trading volumes under $1,000. |

| Robinhood Crypto | 0.00% | 0.00% | No direct commissions, but earns from the bid-ask spread. |

In the end, there's no single "best" platform—it all comes down to aligning your personal trading habits with an exchange's fee structure. Whether you're a small-time trader or a high-frequency pro, the right fit is out there.

Actionable Strategies to Reduce Trading Costs

Understanding exchange fees is one thing, but actually putting that knowledge to work is what really separates the sharp traders from everyone else. It’s not just about picking a platform with low fees. You can get proactive and use specific techniques to slash your trading costs. These aren't closely guarded secrets, just practical, repeatable moves that directly pad your net returns.

The single biggest change you can make? Ditch market orders and embrace limit orders. When you place a market order, you're a "taker," essentially paying a premium to jump the line and execute instantly. But by placing a limit order, you become a "maker," adding liquidity to the order book and getting rewarded with much lower—or even zero—fees.

Become a Maker, Not a Taker

Let's say you want to buy Ethereum at $3,500, but the market is currently trading at $3,510. Instead of smashing the "buy" button at the market price, you set a limit order to purchase at your target of $3,500. Now your order is on the books, waiting for the price to come to you. By doing this, you've just provided a potential buy point for sellers, which makes you a market maker.

This simple switch has a direct impact on your bottom line. Across hundreds of trades, the savings from maker fee discounts can compound into a serious amount of cash, giving your entire portfolio a boost.

A seasoned trader rarely pays taker fees. They plan their entries and exits with limit orders, letting the market come to them. This patience is a core part of learning how to trade crypto without fees.

Leverage Exchange-Specific Incentives

Many exchanges roll out unique perks to lower your costs, and tapping into them can give you a major edge. One of the most common is holding the exchange's own native token.

For instance, platforms like Binance (BNB) and KuCoin (KCS) give fee discounts to users holding a certain amount of their tokens. It's often a tiered system—the more native tokens you hold, the bigger the fee discount you get. This is a smart play for the exchange, driving demand for their token while rewarding their most loyal users.

Staking programs are another powerful tool. Beyond just earning passive income on your crypto, some platforms offer extra benefits like fee reductions for stakers. If you're planning on holding certain assets for the long haul anyway, checking out the staking options on vTrader could unlock several benefits at once, from potential fee advantages to yield generation.

Time Your Trades Around Promotions

Never underestimate the power of a good promotion. Exchanges often run zero-fee trading events for specific pairs—or even across their entire platform—to pull in new users and crank up the trading volume. These events are golden opportunities for anyone looking to make large trades or rebalance a portfolio without getting hit by costs.

To make the most of these, you need to be strategic:

- Follow Exchange Announcements: Keep a close watch on the official blogs, social media accounts, and newsletters of the exchanges you use.

- Plan Ahead: If you know a zero-fee promo for an asset you're watching is on the horizon, you can line up your trades to coincide with it.

- Act Quickly: These promotions are almost always time-sensitive, so being ready to jump when they go live is key to maximizing the benefits.

By mixing these three strategies—being a maker, using native tokens, and jumping on promotions—you can build a solid framework for keeping your expenses to a minimum. This proactive approach turns fee management from a headache into an active part of your trading game plan.

Avoiding the Hidden Costs of Crypto Trading

So you've found a platform that boasts zero-commission trading. That's a great start, but truly mastering how to trade crypto without fees means you need to look a little deeper. There are a few "hidden" costs that can sneak up and eat into your profits if you're not paying attention.

These aren't direct charges on your account, but they act just like fees by chipping away at your returns.

The biggest culprit here is almost always slippage. This is the subtle—and sometimes not-so-subtle—gap between the price you see when you click "buy" or "sell" and the actual price your trade goes through at. It might seem like just a fraction of a penny, but in a market that moves in milliseconds, those fractions can add up fast.

Slippage becomes especially dangerous when you're dealing with coins that have low liquidity. With fewer buyers and sellers on the books, one large order can shove the price around before your own trade gets filled.

Strategies to Minimize Hidden Costs

The good news is you don't have to just accept these indirect costs. A few smart adjustments to your trading strategy can make a world of difference in protecting your capital.

One of the easiest ways to fight back against slippage is to stick with high-liquidity trading pairs. Think of giants like Bitcoin (BTC) and Ethereum (ETH). Their massive trading volumes create deep markets, meaning there are almost always enough buyers and sellers to absorb your order without the price slipping away from you.

Another area to watch is network and withdrawal fees when you move crypto out of an exchange. These can be shockingly high, especially on congested networks like Ethereum during peak hours. A seasoned trader knows how to get around this:

- Batch Your Withdrawals: Instead of pulling out small amounts here and there, group them into larger, less frequent transactions. This dramatically cuts down on how many times you have to pay the network fee.

- Pick Cheaper Networks: If the exchange gives you options, always check for a less expensive network. Moving a stablecoin on Polygon or TRON, for instance, is often significantly cheaper than using the Ethereum mainnet.

The goal isn't just to avoid commissions; it's to get a full picture of your real trading expenses. Once you understand and start managing slippage and withdrawal costs, you’re moving beyond simple participation and truly optimizing your portfolio for growth.

For anyone looking to dive even deeper into these kinds of essential trading concepts, the vTrader Academy is packed with resources. Exploring the in-depth guides and tutorials on vTrader can arm you with the skills to navigate the crypto market with real confidence. Mastering these details is what separates the average trader from a strategic one.

Common Questions About Fee-Free Crypto Trading

Even with a solid game plan, diving into fee-free trading can bring up a few questions. The idea of truly costless trades often sounds too good to be true, and frankly, a healthy dose of skepticism is smart in this space. Let's clear the air and tackle some of the most common things traders ask when they first learn how to trade crypto without fees.

One of the first questions on just about everyone's mind is whether "zero-fee" exchanges are actually free. It’s a bit of a nuanced answer. While platforms like vTrader get rid of direct trading commissions, some other exchanges make up for it with wider bid-ask spreads.

This just means there's a small gap between the highest price a buyer is willing to pay and the lowest price a seller will take. That spread is essentially an indirect cost, so it’s always a good idea to compare the final asset price you're getting, not just the advertised fee.

Is It Better to Be a Maker or a Taker?

When it comes to saving money, being a "maker" is almost always the way to go. Makers are the traders who add liquidity to the market—they do this by placing limit orders that don't get filled instantly. Because these orders help keep the market stable and deep, exchanges often reward makers with much lower fees, sometimes even zero.

"Takers," on the other hand, are traders who use market orders for immediate execution. This action removes liquidity from the order book. While it’s convenient, that instant gratification usually comes at a cost in the form of higher trading fees.

By simply shifting your strategy from market orders to limit orders, you can fundamentally change your cost structure. This one change puts you in control and is a cornerstone of cost-effective trading.

How Can I Reduce Crypto Withdrawal Fees?

Withdrawal fees can be a real pain and an often-overlooked expense that eats into your profits. Luckily, there are a couple of smart tactics you can use to keep them to a minimum.

- Batch Your Transactions: Instead of pulling out small amounts frequently, try grouping your withdrawals into larger, less frequent transfers. This dramatically cuts down on how many times you have to pay a fixed withdrawal fee.

- Use Cheaper Networks: Many cryptocurrencies can be sent over multiple blockchain networks. If your exchange gives you the option, check if you can withdraw using a more affordable network like Polygon or another Layer 2 solution. These are often far cheaper than the congested and pricey Ethereum mainnet.

Finally, there's a common myth that you need a massive trading volume to get low fees. While it’s true that being a high-volume whale unlocks the best rates on many exchanges, it’s not the only path forward. You can use platforms with low flat fees, jump on promotional zero-fee periods, or simply focus on being a maker.

For more detailed answers, you can always check out the comprehensive vTrader FAQ page for more insights.

Ready to stop paying commissions and start maximizing your profits? vTrader offers the tools, security, and zero-fee environment you need to succeed. Sign up today and experience the difference.

Steve Gregory is a lawyer in the United States who specializes in licensing for cryptocurrency companies and products. Steve began his career as an attorney in 2015 but made the switch to working in cryptocurrency full time shortly after joining the original team at Gemini Trust Company, an early cryptocurrency exchange based in New York City. Steve then joined CEX.io and was able to launch their regulated US-based cryptocurrency. Steve then went on to become the CEO at currency.com when he ran for four years and was able to lead currency.com to being fully acquired in 2025.