If you’ve ever wondered how to earn crypto, the answer might be simpler than you think. It's no longer a secret society for tech wizards. Today, some of the most common paths involve staking your existing assets, diving into DeFi with yield farming, or even freelancing for crypto payments. These strategies open up a whole new world for growing your digital portfolio.

Your Starting Point For Earning Cryptocurrency

Before you jump into the deep end, it’s smart to get a lay of the land. The methods for earning crypto run the gamut from passive, long-term holds to active, daily engagement. The right path for you really hinges on your personal goals, how much risk you're comfortable with, and the amount of time you can sink into it.

Think of it like deciding between a high-yield savings account and day trading stocks. Both can build wealth, but they demand completely different mindsets and levels of attention. This guide is here to break down the most effective techniques, giving you a clear roadmap for both passive income streams and more active earning opportunities.

HODL: The Original Crypto Strategy

Long before complex DeFi strategies came along, there was HODL. The term, born from a now-famous typo in an old forum post, has become a core philosophy in crypto: buy and hold on for dear life, riding out the market’s wild swings with the expectation of long-term growth.

This patient approach has been a game-changer for many early Bitcoin investors. And it’s not just for OGs—as of 2025, about 28% of American adults own cryptocurrency, a sign of growing mainstream belief that supports long-term holding.

A key takeaway here is that you don't need to be a trader to win in crypto. Sometimes, the most profitable move is simply doing nothing and patiently holding assets you believe in for the long haul.

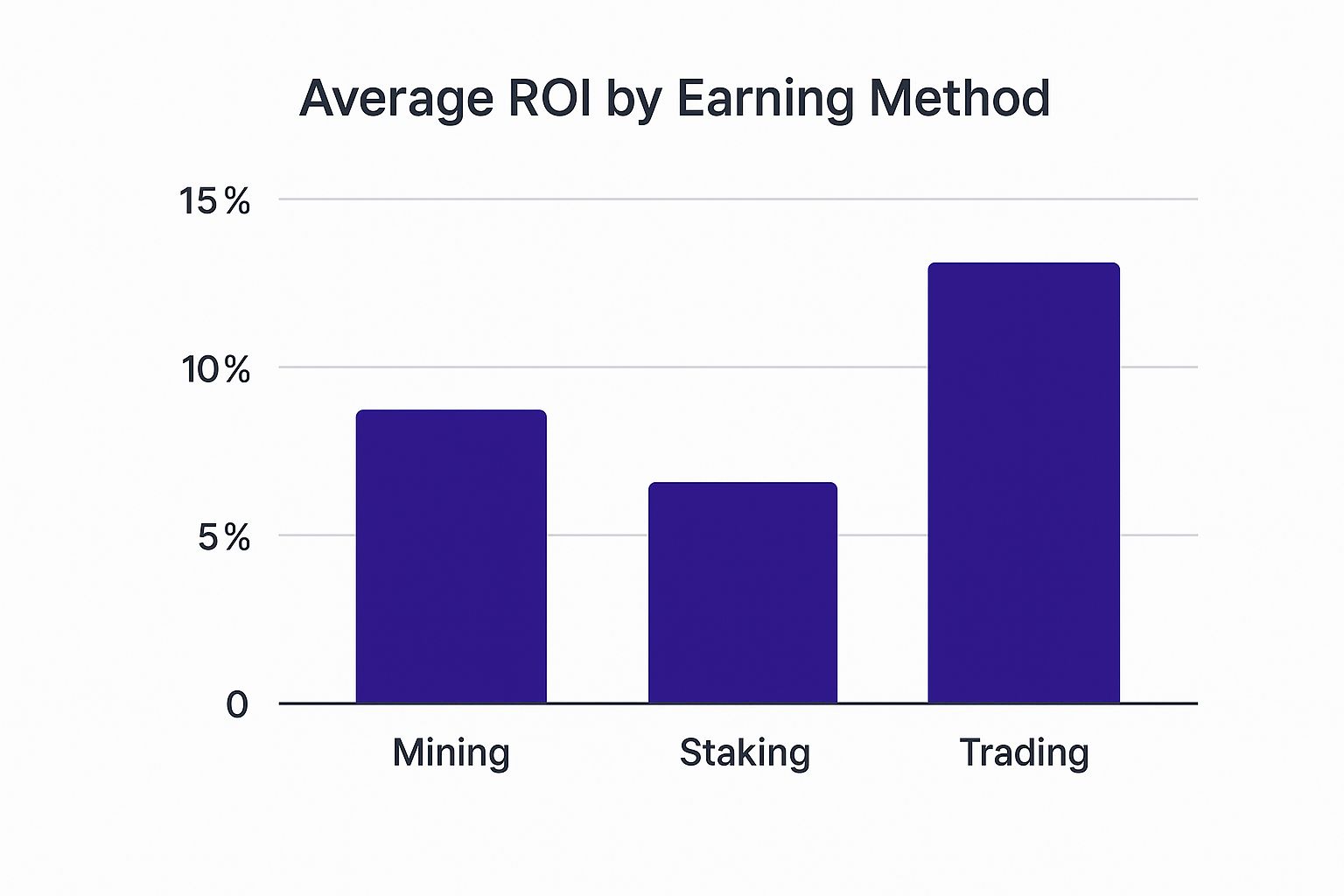

The image above gives you a quick visual on the potential returns for a few popular earning methods. Notice how active trading often promises higher rewards, but that always comes with more risk and requires a lot more work.

To stay on top of market trends that could sway your decisions, you might want to keep an eye on our up-to-date crypto news and analysis.

Crypto Earning Methods At a Glance

To help you figure out where to start, it’s useful to see how different earning strategies stack up against each other. Each one has its own unique blend of risk, effort, and potential reward.

This table provides a high-level comparison of different crypto earning methods, outlining their typical risk level, effort required, and potential rewards to help you choose the best fit.

| Earning Method | Risk Level | Effort Required | Potential Return |

|---|---|---|---|

| Staking | Low to Medium | Low | Low to Medium |

| Yield Farming | Medium to High | Medium | Medium to High |

| Mining | High | High | Medium to High |

| Trading | High | High | High |

| Freelancing | Low | Medium | Varies |

| Airdrops | Low | Low to Medium | Low to High |

Ultimately, there's no single "best" way to earn crypto—it's all about finding the method that aligns with your financial goals and personal style. Whether you prefer a set-it-and-forget-it approach or want to be in the trenches daily, there's a path for you.

Earn Passive Income with Staking and Yield Farming

If you're already holding crypto, the next logical step is to make it work for you. Two of the most common ways to do just that are through staking and yield farming. These strategies can turn your idle digital assets into a source of passive income.

Think of staking as the crypto version of a high-yield savings account. You lock up your tokens to help secure a blockchain network, and in return, the network rewards you with more tokens. It's a straightforward way to contribute to the ecosystem and earn at the same time.

Understanding Crypto Staking

Staking is the backbone of blockchains that operate on a Proof-of-Stake (PoS) consensus mechanism. It’s a much more energy-efficient alternative to Bitcoin’s Proof-of-Work model. PoS networks rely on participants, known as validators, who lock up—or "stake"—their own crypto as collateral to validate new transactions.

It's a win-win situation. The network becomes more decentralized and secure, and you earn rewards for your participation. This has quickly become one of the most accessible methods for generating passive crypto income, used by major blockchains like Ethereum, Cardano, and Solana. Depending on the network and market conditions, it's not unusual to see annual percentage yields (APYs) ranging from 5% to 20%.

Getting started with staking is easier than you might think. There are two main paths you can take:

- Staking on an Exchange: This is the beginner-friendly route. Platforms like Kraken or Binance handle the technical side of things. You just deposit your crypto and opt into their staking program.

- Direct or Native Staking: For those who want more control and potentially higher returns, staking directly on a network is the way to go. Using a compatible wallet like MetaMask or Yoroi, you can stake your assets without a middleman, but it does require a bit more technical confidence.

For a deeper dive into specific staking opportunities and how platforms implement them, check out Yieldseeker's dedicated staking page.

Getting Started with Yield Farming

If staking is the reliable savings account, yield farming is its more adventurous and potentially more lucrative cousin. Also known as liquidity mining, yield farming involves lending or staking your crypto assets in various decentralized finance (DeFi) protocols to chase the highest returns.

Here's how it generally works: You provide liquidity to a decentralized exchange (DEX) like Uniswap or a lending platform like Aave. By adding your tokens to what's called a liquidity pool, you help other users trade or borrow those assets. As a reward for providing this service, you earn a cut of the transaction fees and, often, bonus governance tokens from the protocol itself.

Yield farming is all about actively hunting for the best returns across the vast DeFi landscape. It demands more research and hands-on management than staking, but the rewards can be substantially higher.

The Risks You Need to Know

Of course, higher potential rewards almost always come with higher risks. Before you jump into yield farming, it's critical to understand what you're up against. The biggest risk is something called impermanent loss. This occurs when the price of the tokens you deposited in a liquidity pool changes significantly. If one token's value shoots up while the other stays flat, you might find you would have been better off just holding the assets in your wallet.

On top of that, DeFi can still feel like the wild west. Smart contract bugs and rug pulls—where developers abandon a project and disappear with investor funds—are very real threats. Always do your own research, start with an amount you're comfortable losing, and try to stick with well-known, audited platforms.

If you prefer a more guided approach to earning rewards, take a look at our detailed guide on crypto staking opportunities.

Active Earning with Crypto Mining and Trading

While staking offers a great "set it and forget it" way to grow your crypto holdings, some people just prefer to be in the driver's seat. For anyone ready to roll up their sleeves, crypto mining and active trading are two powerful, hands-on methods that can unlock much higher returns.

They definitely require more effort, knowledge, and capital, but the payoff can be substantial.

Mining is the OG method for creating new coins. It's the engine that powers networks like Bitcoin, where miners verify transactions and add them to the blockchain. For all that computational muscle, they get rewarded with freshly minted crypto.

The Modern Reality of Crypto Mining

Let's be real: the glory days of mining Bitcoin on your home gaming PC are long gone. Mining has morphed into a cutthroat, industrial-scale operation. You need serious hardware and a solid grasp of your operational costs to even think about turning a profit.

If you're serious about getting into mining today, you're looking at two main routes:

- ASIC Miners: These are Application-Specific Integrated Circuit machines, and they do one thing exceptionally well: mine a specific crypto algorithm. They're absolute beasts but come with a hefty price tag and an even heftier electricity bill.

- Cloud Mining: This is a more accessible path. You essentially rent hashing power from a massive data center that handles all the hardware and maintenance. It lowers the barrier to entry, but you're paying fees, and you have to trust the company you're working with.

Your profitability hinges on a constant dance between your hardware costs, the network's ever-increasing difficulty, and, critically, the price of electricity. If you're keen on securing the network while earning rewards, understanding how Bitcoin mining works is the first crucial step.

The Dynamics of Active Crypto Trading

If mining is about building the infrastructure, active trading is about capitalizing on its market volatility. This is a world away from simply buying and holding. Active traders live and breathe the charts, aiming to profit from short-term price swings.

A couple of popular strategies dominate the space, each with its own rhythm and risk:

- Day Trading: This is high-octane stuff. You're opening and closing trades within a single day, trying to skim profits from tiny price movements. It’s intense and demands constant attention. Not for the faint of heart.

- Swing Trading: This approach is a bit more patient. Swing traders look to capture larger price "swings" over several days or weeks, using technical analysis to spot trends and ideal entry or exit points.

No matter your strategy, risk management is everything. The single most important tool in your arsenal is the stop-loss order. This automatically sells your asset if it drops to a certain price, putting a hard cap on your potential losses when the market inevitably moves against you.

A cardinal rule every trader learns—often the hard way—is to never risk more on a single trade than you're truly willing to lose. Stop-loss orders are how you enforce that discipline and protect your capital from getting wiped out during a flash crash.

The numbers show that interest in these active strategies isn't slowing down. The global crypto market was valued at $4.67 billion in 2022 and is projected to grow at a compound annual rate of 12.5% through 2030. That kind of sustained investment fuels opportunity. For savvy traders, this can also extend to affiliate earnings, like those offered by the vTrader affiliate program, which can add another layer to your income stream.

Earn Crypto Without Investment: Airdrops and Gigs

Not everyone wants to jump into crypto by buying it outright. The good news is, you don't have to. If you've got some time and marketable skills, you can start building a digital portfolio from scratch through things like crypto airdrops and freelance gigs.

These methods are all about participation and contribution. Think of airdrops as a reward for being an early bird—new projects give away free tokens to build a community and create some buzz. It's a marketing tactic where you, the user, get a piece of the pie just for showing up.

Unlocking Value Through Airdrops

At its core, an airdrop is a simple concept. A new protocol, often on a bustling ecosystem like Ethereum or Solana, distributes its own token directly into the wallets of active users. The idea is to get the token into the hands of real people who might actually use it, not just traders looking for a quick flip.

The most legendary airdrop story is hands-down Uniswap. Back in 2020, the decentralized exchange dropped 400 UNI tokens into every wallet that had ever used the protocol. At the time, it was a nice little bonus. A year later? Those tokens were worth over $15,000—a truly life-changing sum for many of its early supporters.

So, how do you put yourself in the running for the next big one?

- Be a Real User: The best strategy is to genuinely explore new and promising platforms. Try out new decentralized exchanges, move assets across different networks, and mint an NFT on an up-and-coming marketplace.

- Get Your Hands Dirty on Testnets: Before a project goes live on the main network, it usually runs a public testnet. Participating in these tests—finding bugs, giving feedback—is a classic way projects spot their most dedicated users for future rewards.

- Follow the Right People: Keep a close eye on X (formerly Twitter) and get active in project communities on Discord or Telegram. This is ground zero for airdrop announcements and eligibility rules.

Don't waste your time chasing every rumor you hear. Focus on projects with solid funding, strong tech, and a team that's actively building. Your time is your most valuable asset here, so invest it in protocols with a real chance of making it.

Getting Paid in Crypto for Your Skills

Beyond just using new protocols, you can earn crypto directly by putting your professional skills to work. The digital economy has opened up a huge market for freelancers who'd rather be paid in Bitcoin, Ethereum, or stablecoins like USDC. It's a straightforward way to stack crypto without worrying about market swings.

A bunch of platforms have popped up to connect skilled pros with companies deep in the Web3 world. Whether you're a writer, designer, developer, or marketer, there’s almost certainly a gig out there for you.

Where to Find Crypto Gigs

| Platform Type | Examples | Best For |

|---|---|---|

| Crypto-Native Job Boards | CryptoJobs, Web3.career | Finding full-time or part-time roles specifically within the crypto industry. |

| Freelance Marketplaces | Upwork, Fiverr | Offering specific services and setting your payment preference to cryptocurrency. |

| Project DAOs | Gitcoin, RaidGuild | Contributing to decentralized autonomous organizations (DAOs) and earning rewards for completed tasks or "bounties." |

Getting paid in a stablecoin like USDC is a smart move if you want the benefits of crypto payments—like near-instant global transfers—without the price rollercoaster of assets like Bitcoin. You can secure your earnings and then decide when and if you want to swap them for something else.

New Frontiers: Learn and Play to Earn

The "earn" model just keeps getting more creative. Two other methods gaining serious traction are learn-to-earn and play-to-earn, turning education and gaming into ways to generate income.

Learn-to-earn programs, often run by exchanges, give you small amounts of crypto just for watching short videos or completing quizzes about different projects. It's a fantastic way to learn the basics while getting your first few digital coins.

Play-to-earn (P2E) games use blockchain to give players actual ownership of their in-game items as NFTs. By just playing the game, you can earn tokens or valuable NFTs that you can then sell on an open market, turning your gaming hobby into a potential revenue stream.

How to Protect and Manage Your Crypto Earnings

https://www.youtube.com/embed/LGHsNaIv5os

Figuring out how to earn crypto is an incredible feeling, but that’s only half the battle. Now comes the hard part: protecting and managing those assets so they don’t vanish overnight. Without a solid game plan for security and risk, your hard-won earnings could be gone in a flash.

Let's be real—the crypto world is thrilling, but it's also the Wild West. You’ve got everything from insane market swings to incredibly clever scams to worry about. A smart investor doesn't try to avoid risk entirely, because that’s impossible. Instead, you learn to manage it so you can stick around for the long haul.

Diversify Your Crypto Portfolio and Methods

You’ve heard it a million times in traditional finance: don't put all your eggs in one basket. That advice is ten times more important in crypto. Diversification is your best defense against sudden market crashes and protocol-specific failures.

But it’s not just about spreading your money across different coins. You need to diversify your earning methods, too.

For example, you could balance the high-stakes game of yield farming with something more predictable, like staking a blue-chip coin like Ethereum. This builds resilience into your portfolio. If that risky farm you're in suddenly collapses, your steady staking rewards can help cushion the fall.

Here’s one way to think about structuring your portfolio:

- High-Risk (10-20%): This is your "play money." Use it for experimental stuff like yield farming on brand-new protocols or taking a shot on low-cap altcoins.

- Medium-Risk (30-40%): Put a decent chunk into more established DeFi protocols or stake mid-cap coins that have proven they have solid fundamentals.

- Low-Risk (40-60%): The bulk of your capital should sit in heavyweights like Bitcoin and Ethereum. You can hold them or stake them for more modest but reliable returns.

This tiered approach lets you chase exciting gains while keeping a strong foundation.

Secure Your Assets with Hardware Wallets

One of the biggest and most painful mistakes I see new people make is leaving their crypto on an exchange. Yes, it’s convenient for trading, but exchanges are centralized companies. They hold your private keys, which means they control your funds, not you. If that exchange gets hacked or goes belly-up, your assets could be lost forever.

The golden rule of crypto is simple: Not your keys, not your coins. The only way to truly own your crypto is to control your own private keys.

This is exactly what hardware wallets are for. Devices from companies like Ledger and Trezor are small physical gadgets that keep your private keys completely offline. To send a transaction, you have to physically connect the device and press a button to approve it. This makes it virtually impossible for an online hacker to get their hands on your funds.

Think of it this way: leaving crypto on an exchange is like leaving cash in a bank that has no insurance. A hardware wallet is your own personal, high-security vault.

Crypto Security Checklist

Getting your security right from the start is non-negotiable. It can feel overwhelming, but focusing on a few key actions will protect you from the vast majority of threats out there.

Here’s a straightforward checklist to get your defenses in order.

| Security Action | Why It's Important | Recommended Tools |

|---|---|---|

| Use a Hardware Wallet | It moves your private keys offline, making them immune to online threats like malware and phishing attacks. | Ledger Nano S/X, Trezor Model One/T |

| Enable 2FA Everywhere | This adds a crucial second layer of security to your exchange and email accounts, stopping unauthorized logins. | Authy, Google Authenticator |

| Use a Unique, Strong Password | Protects against "credential stuffing," where hackers use passwords stolen from other website breaches. | 1Password, Bitwarden |

| Bookmark Official Sites | Stops you from falling for phishing scams that use fake websites to steal your login details or seed phrase. | Your browser's bookmark feature |

| Never Share Your Seed Phrase | Your 12 or 24-word phrase is the master key to your wallet. Anyone who has it can drain all your funds. | Write it down and store it offline in multiple secure locations. |

Treat this list as your foundation. Consistently applying these practices will put you miles ahead of most people in terms of security.

Don't Forget About Taxes

Finally, managing your earnings properly means keeping things square with the tax authorities. In most countries, earning crypto is a taxable event. Whether you got it from staking rewards, sold an asset for a profit, or were paid for freelance work, you probably owe taxes.

Keeping meticulous records of every single transaction—every buy, sell, swap, and reward—is non-negotiable. Ignoring this will create a massive headache and could lead to serious penalties later. Services like Koinly or CoinLedger can be lifesavers, automatically tracking your activity and generating tax reports. It's a small investment that can save you a world of trouble.

Also, always pay attention to transaction costs, as they can add up and affect your tax liability. Understanding a platform's fee model, like the one in our detailed fee schedule, is essential for accurate accounting.

Your Crypto Earning Questions Answered

Diving into the world of crypto earning can feel like learning a new language. As you start exploring different methods, it's natural for a few key questions to pop up. This final section tackles some of the most common queries we hear, giving you the clarity and confidence to move forward.

What Is the Easiest Way to Start Earning Crypto?

For anyone just getting their feet wet, the path of least resistance is usually the smartest one. You'll want a method that skips the technical headaches and lets you start earning quickly without a steep learning curve. In my experience, two options really stand out here.

The first is staking through a centralized exchange. Platforms like vTrader or Kraken have made this process incredibly straightforward. You just deposit your crypto, find the "Earn" or "Staking" section, and opt-in with a few clicks. The exchange handles all the complicated backend stuff, like running a validator node, so you can simply sit back and watch the rewards roll in.

Another fantastic starting point is learn-to-earn programs. These are literally designed for newcomers. By watching short educational videos and acing simple quizzes on different crypto projects, you can earn small amounts of various tokens. It’s a completely risk-free way to both build a small, diversified portfolio and gain valuable knowledge about the ecosystem.

For many, the choice comes down to this: If you already own some crypto, exchange staking is the easiest way to make it productive. If you're starting from absolute zero, learn-to-earn programs are your best bet for getting some skin in the game for free.

How Much Money Do I Need to Start?

This is one of the biggest myths in the crypto space. So many people think you need thousands of dollars to get going, but that's just not the case. The reality? You can begin your crypto earning journey with as little as $10 or even with no money at all.

Here’s a quick breakdown of the starting capital needed for different methods:

- No-Cost Methods: Airdrops, learn-to-earn programs, and freelancing gigs require an investment of your time and skills, not your money. You can absolutely build a portfolio from the ground up without spending a dime.

- Low-Cost Methods: Staking on many exchanges lets you start with pocket change. You could buy just $20 worth of a Proof-of-Stake coin and start earning interest on it immediately.

- Higher-Cost Methods: Things like active trading, and especially mining, demand more significant capital for hardware, software, and to absorb potential losses.

The key is to start within your means. The crypto world is packed with opportunities that don't require a huge upfront investment. Never feel pressured to put in more than you are comfortable losing.

Are My Crypto Earnings Taxable?

Yes. In most countries, your crypto earnings are absolutely subject to taxes. This is a critical point that newcomers often overlook, and it can lead to major headaches down the road. Governments typically view cryptocurrency as property, not currency, for tax purposes.

This has a few important implications for you. Generally, you’ll trigger a taxable event when you:

- Sell crypto for fiat currency (like USD or EUR).

- Trade one cryptocurrency for another (e.g., swapping Bitcoin for Ethereum).

- Use crypto to pay for goods or services.

- Receive crypto as income (from staking, mining, airdrops, or freelance work).

The rules can get complicated and vary by country, but the universal principle is that you must track your activity. Keeping meticulous records of every single transaction—the date, the crypto, its value at the time, and the purpose—is non-negotiable. Using crypto tax software can automate this and save you a world of trouble.

Because tax regulations are constantly evolving, it's always smart to consult a qualified tax professional in your area. For more general guidance on common crypto topics, you can always check out our extensive crypto FAQ page for straightforward answers.

Ready to put your knowledge into action? vTrader offers a secure, commission-free platform to start your crypto journey. With zero-fee trading on over 30 coins, advanced tools, and a built-in learning academy, we give you everything you need to trade, stake, and grow your portfolio with confidence. Sign up today and get a $10 bonus to kickstart your earnings!

Steve Gregory is a lawyer in the United States who specializes in licensing for cryptocurrency companies and products. Steve began his career as an attorney in 2015 but made the switch to working in cryptocurrency full time shortly after joining the original team at Gemini Trust Company, an early cryptocurrency exchange based in New York City. Steve then joined CEX.io and was able to launch their regulated US-based cryptocurrency. Steve then went on to become the CEO at currency.com when he ran for four years and was able to lead currency.com to being fully acquired in 2025.