So, you're ready to jump into crypto. It can feel like stepping into a whole new universe, but getting started is simpler than you might think. The key is to pick a reliable exchange like vTrader, get your account set up securely, and wrap your head around the big players like Bitcoin and Ethereum.

Your First Steps Into the World of Crypto

Let's get one thing straight: you don't need a PhD in computer science or a Wall Street background to start your crypto journey. The most important thing is to just begin, but to do it with a solid, practical foundation. This guide is all about giving you that confidence by focusing on what you actually need to do, not burying you in technical jargon.

The crypto market is always buzzing with activity. It's known for its wild swings, but the overall trend shows massive growth. The global market was valued at around USD 6.78 billion in 2024 and is on track to hit USD 15.03 billion by 2030. That’s a clear sign of growing interest and adoption, especially in developing countries.

Getting to Know Your First Options

Before you put any money on the line, it’s smart to understand what you're buying. For nearly every beginner, the crypto journey kicks off with one of two household names: Bitcoin (BTC) or Ethereum (ETH). People often lump them together, but they’re built for very different things.

- Bitcoin (BTC): This is the OG, the one that started it all. Think of it as digital gold. Its main job is to be a store of value and a way to send money without a bank.

- Ethereum (ETH): This is much more than just a coin. It’s a global computing platform that lets developers build and run decentralized applications (dApps) and smart contracts. It powers everything from new-age finance to digital art and gaming.

To really see the difference, a quick comparison can help.

A Quick Look at Major Cryptocurrencies

This table breaks down the core distinctions between Bitcoin and Ethereum, helping you see where each one shines.

| Feature | Bitcoin (BTC) | Ethereum (ETH) |

|---|---|---|

| Main Purpose | Digital Store of Value & Peer-to-Peer Cash | Programmable Blockchain & dApp Platform |

| Analogy | Digital Gold | The Internet's Operating System |

| Best For | Long-term holding and simple transactions | Interacting with decentralized finance (DeFi) & NFTs |

At the end of the day, they both offer a great entry point into the market.

Don’t get paralyzed trying to pick the “perfect” crypto right out of the gate. The real goal for a beginner is to get comfortable with the whole process—buying, holding, and watching how the market moves with a well-known asset.

Now, before you even click "buy," it’s absolutely essential to get your financial house in order. This isn’t just about crypto; it’s about smart money management. Having a clear budget and understanding your own risk tolerance is non-negotiable. For a deep dive, check out a comprehensive guide to financial planning for beginners.

As you keep going, remember that knowledge is your best defense in this space. For more lessons and tutorials designed specifically for new investors, the vTrader Academy is an excellent resource to help you build on what you've learned here.

Setting Up and Securing Your vTrader Account

Getting your vTrader account live is your first real move into the world of crypto investing. The sign-up is quick, but it's the security steps you take right now that will set you up for success and keep you safe down the road. Let's get it done right.

First, you'll go through the standard sign-up motions—name, email, the usual stuff. Shortly after, vTrader will guide you through its Know Your Customer (KYC) check. This just means you'll need to submit an ID, like a driver's license. It might seem like a hassle, but this is a good thing. KYC is how regulated platforms like vTrader keep bad actors out and help prevent fraud, which is a layer of protection for everyone, including you.

Bolstering Your Account's Defenses

Think of your new account like a digital safe. You wouldn't secure it with a flimsy padlock, and the same logic applies here. Your password is your first line of defense, so make it a good one. A long, random phrase with a mix of letters, numbers, and symbols is always a better bet than a simple word you might use elsewhere.

Next up is the one security step you absolutely cannot skip: enabling Two-Factor Authentication (2FA). This adds a crucial second check, usually a code from your phone, before anyone can access your account.

Expert Take: While getting a code via SMS is better than nothing, I always tell new investors to use an authenticator app like Google Authenticator or Authy. Why? Because phone numbers can be hijacked in what’s called a "SIM swap" attack. An authenticator app is tied to your physical phone, making it much harder to compromise.

Here’s the quick-and-dirty on setting it up:

- Head to the security settings in your vTrader profile.

- Choose to enable 2FA and use your app to scan the QR code that pops up.

- Crucially, write down the backup recovery code and put it somewhere safe offline. Don't just save a screenshot or a note on your computer where a hacker could find it.

Taking this one action is a massive security upgrade. In fact, research shows that using 2FA can block an astounding 99.9% of automated bot attacks aimed at stealing accounts.

How to Spot Scammers from a Mile Away

As soon as you step into the crypto world, you become a target for scammers. They use slick tricks called phishing to try and fool you into handing over your login info. Your best defense is simply knowing what to look for.

Real-World Phishing Scams to Watch For

| Scam Tactic | How It Plays Out | The Smart Move |

|---|---|---|

| The Fake "Security Alert" | You get a frantic-looking email, supposedly from vTrader, saying your account is at risk. It pushes you to click a link to "secure your account," but the link goes to a perfect copy of the vTrader login page designed to steal your credentials. | Always check the sender's email address. Better yet, never click links in security emails. Just open a new browser tab, type vtrader.io yourself, and log in directly to see if there are any real notifications. |

| The "Free Crypto" DM | Someone slides into your DMs on Twitter or Telegram, offering to double your crypto if you just send a small amount to their wallet first. This is a timeless advance-fee scam. | No legitimate company or giveaway will ever ask you to send them crypto to receive crypto. It’s a classic red flag. If it sounds too good to be true, it is. Block, report, and move on. |

Good security isn't just a one-and-done setup—it's a habit. By creating a unique password, locking down your account with app-based 2FA, and staying sharp to phishing tactics, you're building a strong foundation to start investing in cryptocurrency with real confidence.

Funding Your Account and Making a First Trade

Now that your vTrader account is set up and secure, it's time for the real action. The next move is getting some funds in there, which is what turns your account from an empty shell into a real tool for your crypto journey. This is where the theory ends and practice begins, and honestly, it’s much simpler than most people think.

You’ve got a couple of straightforward ways to deposit money on vTrader. Most people just starting out go with a direct bank transfer, also known as an ACH transfer. This is a solid, reliable method that usually has the lowest fees, so it's a great way to save a bit of cash. The only trade-off is speed—an ACH transfer might take a few business days to clear before you can start trading.

If you’re in a hurry, you can also use a debit card for instant deposits. This is perfect if you spot an opportunity and want to jump on it right away. It's super convenient, but keep in mind that debit card deposits can sometimes come with a small processing fee. To get the full picture on costs, you can check out the details on the vTrader fee schedule.

A Personal Tip: When I was starting out, I found a hybrid approach worked best. I linked my bank account for my bigger, planned deposits to keep fees at a minimum. At the same time, I kept my debit card connected for those moments when I needed to top up my account quickly because the market was making a move. It gave me the best of both worlds: low costs and flexibility.

Placing Your First Order

Alright, this is the exciting part—making that first purchase. Let's walk through a classic scenario for a newcomer: buying $100 worth of Bitcoin (BTC). The process on vTrader is really intuitive, but it pays to understand your order options to make sure your first move is a smart one.

Once the funds hit your account, head over to the trading screen for Bitcoin. You'll see two main choices for buying: a market order and a limit order.

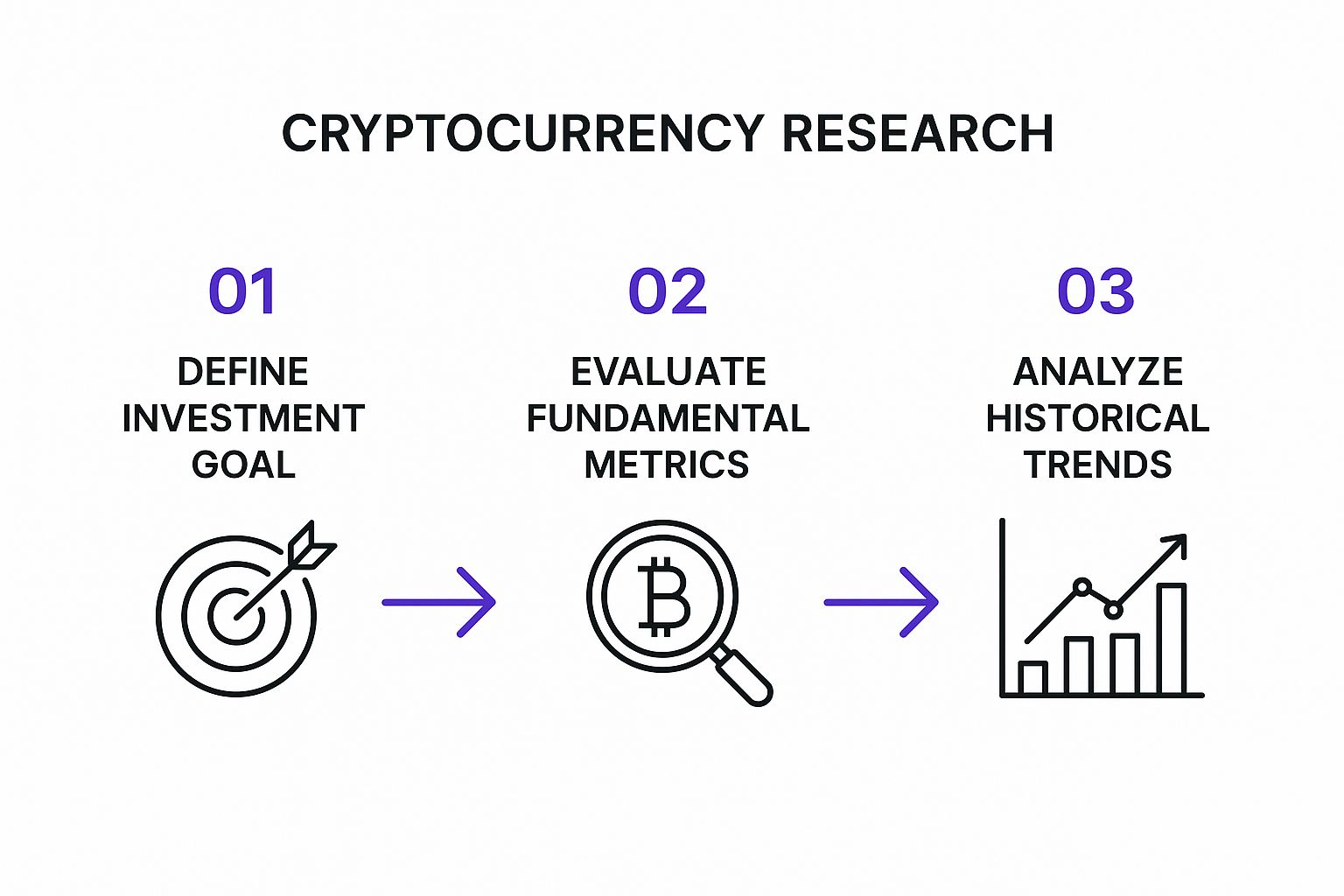

Before you pull the trigger, though, good investing always starts with good research. This is the basic framework I recommend to anyone before they buy their first asset.

As you can see, it all begins with having a clear goal. From there, you dig into the asset's real value and its history. Only then are you ready to buy.

Here's what those order types mean:

- Market Order: Think of this as the "buy it now" button. A market order gets you your crypto immediately at whatever the best current price is. It’s the simplest option and guarantees your order goes through without any fuss.

- Limit Order: This one gives you more control over the price you pay. With a limit order, you set a specific price you're willing to buy at. For instance, if Bitcoin is trading at $60,000, you could set a limit order to buy only if the price falls to $59,500. Your order will only get filled if the market price actually hits your target.

For your very first trade, a market order is often the most stress-free way to go. It gets you in the game and helps you get a feel for how the platform works. Just enter $100, choose "Market Order," and hit confirm.

And just like that—congratulations, you're officially a crypto investor.

Smart Investment Strategies for Newcomers

Jumping into the crypto market without a plan is a recipe for disaster. It's like trying to navigate a new city without a map—you might stumble upon something great, but you’re far more likely to get lost and frustrated. Real investing isn't about making wild guesses; it's about having a solid strategy.

Let’s talk about two proven strategies that are perfect for newcomers. These aren't about trying to "time the market," a fool's errand that trips up even seasoned pros. Instead, we'll focus on consistency and long-term thinking, which are the keys to not just surviving but thriving in the volatile world of crypto.

Embrace Dollar-Cost Averaging

Dollar-Cost Averaging, better known as DCA, is a deceptively simple strategy that takes the sting out of market volatility. Instead of throwing a large lump sum in all at once, you invest a fixed amount of money at regular intervals—no matter what the price is doing.

Think of it this way: you decide to invest $100 in Bitcoin every Monday.

- Week 1: Bitcoin's at $60,000. Your $100 gets you a small slice.

- Week 2: The price dips to $55,000. That same $100 now buys you a slightly bigger piece of Bitcoin.

- Week 3: It rallies to $65,000. Your $100 buys you a little less this time.

Over the long run, this method averages out your cost. You automatically buy more when prices are low and less when they are high, building your position steadily without getting swept up in the market frenzy.

The true power of DCA lies in its psychological armor. By putting your investments on autopilot, you sidestep the two biggest portfolio killers: fear and greed. This discipline is what separates successful investors from the rest.

The Art of the HODL

You'll see the term "HODL" plastered all over crypto forums and social media. It famously started as a typo for "hold" in an old Bitcoin forum post and has since morphed into a core crypto philosophy: Hold On for Dear Life. HODLing is all about the long game—you buy a cryptocurrency and hold onto it through thick and thin, believing in its future potential.

This strategy is a lifesaver for beginners because it stops you from panic-selling during the market's inevitable nosedives. The crypto market is notorious for its wild swings. For instance, data from early 2025 showed the total crypto market cap plunged by 18.6% to $2.8 trillion after hitting a peak, with daily trading volumes sinking 27.3%. Yet, amid the chaos, Bitcoin’s market dominance actually grew to 59.1%. These cycles are a natural, expected part of the market’s journey.

Adopting a HODL mindset helps you reframe these downturns. They aren't catastrophes; they're just phases in a much larger, long-term trend.

Managing Risk and Expectations

DCA and HODLing are a powerful duo, but they only work if you pair them with smart risk management. There’s one golden rule every beginner must live by: never invest more than you can comfortably afford to lose. Seriously.

Here are a few practical tips to keep your risk in check:

- Start Small: Your first forays into crypto should be with amounts that won't give you sleepless nights if they vanish.

- Diversify Later: It's smart to stick with established coins like Bitcoin and Ethereum at first. As you get more comfortable, you can start exploring other promising assets.

- Earn While You HODL: If you're holding for the long term, don't let your assets just sit there. You can put them to work. Take a look at how you can learn more about staking on vTrader and earn rewards on your crypto holdings.

By weaving together a disciplined DCA strategy, a long-term HODL mentality, and sensible risk controls, you’re not just investing—you're building a resilient foundation for your entire crypto journey.

Essential Habits of a Savvy Crypto Investor

Beyond specific trading strategies, the real secret sauce that separates seasoned crypto investors from the rest comes down to the habits they practice every single day. These aren't complicated trading maneuvers—they're practical, disciplined approaches that build long-term confidence and resilience. If you're new to the game, adopting these habits is a crucial first step.

The single most important habit, without a doubt, is to Do Your Own Research (DYOR). It’s incredibly tempting to jump on hyped-up coins you see blowing up on social media, but that's a fast track to making emotional, risky bets. Real research means getting your hands dirty: digging into a project's whitepaper, understanding its core purpose, and vetting the team behind it. This proactive mindset helps you invest based on actual value, not just online noise.

This kind of diligence is more critical than ever. In the U.S., about 40% of adults held crypto in 2024, a massive jump from just 15% in 2021. With ownership among women also climbing to 29%, it's clear that crypto is no longer a niche interest.

Avoiding Common Traps and Scams

A sharp eye for red flags is an investor's best defense against the darker side of crypto. A classic scheme to watch out for is the "pump and dump," where scammers use false hype to artificially inflate a coin's price. Once enough new investors have piled in, they sell off their massive holdings, crashing the value and leaving everyone else holding worthless tokens.

One of the biggest takeaways from experienced investors is this: be extremely skeptical of any project promising guaranteed, high returns with zero risk. Legitimate investments always involve risk. If it sounds too good to be true, it almost certainly is.

Keep an eye out for these warning signs:

- Aggressive Marketing: Relentless, high-pressure shilling across social media.

- Anonymous Teams: Legitimate projects are proud of their founders and make them easy to verify.

- Vague Goals: If a project can't clearly state its purpose or lacks a detailed whitepaper, walk away.

Diversify and Track Your Portfolio

Another core habit of smart investors is portfolio diversification. Putting all your capital into a single "hot" coin is the crypto equivalent of putting all your eggs in one basket—it’s incredibly risky. You can start small; even holding just Bitcoin and Ethereum is a solid first step toward spreading your risk. As you get more comfortable, you can slowly expand into other promising projects.

Finally, it’s vital to develop a healthy relationship with tracking your investments. Obsessively staring at charts 24/7 is a recipe for stress and panic-selling. Instead, use the portfolio tools on vTrader to check in on a set schedule—maybe once a day or a few times a week. This keeps you informed without fueling anxiety. On that same note, understanding the platform's rules is just as important. You can review key information in the vTrader refund policy documentation.

Frequently Asked Questions About Crypto Investing

Even with a solid plan, a few questions are bound to pop up. It's a natural part of the learning curve, so let's tackle some of the most common ones I hear from new crypto investors.

Getting clear answers here will help you move forward with more confidence.

How Much Money Do I Need to Start Investing?

You don’t need a fortune to get into crypto. Forget the old days of needing huge sums to buy assets. One of the best things about modern platforms is the ability to buy tiny fractions of coins.

On vTrader, you can get started with as little as $20.

The real question isn't the minimum deposit, though. It's about how much you should invest. The golden rule, especially while you're still getting a feel for the market's rhythm, is to only invest what you are genuinely prepared to lose.

Should I Keep Crypto on an Exchange or a Private Wallet?

This is a key question that really gets to the heart of convenience versus control.

For most beginners, keeping your crypto on a secure, regulated exchange like vTrader is perfectly fine and, honestly, much simpler. The platform handles all the complex security behind the scenes so you can focus on learning to trade.

As your portfolio grows, however, it’s smart to start learning about private wallets—both hardware and software types. Moving your crypto to a private wallet gives you absolute control because you, and only you, hold the keys.

Key Takeaway: Start with the convenience of an exchange. Once you gain experience and your holdings get more substantial, moving your long-term assets to a private hardware wallet is considered a best practice for ultimate security.

Do I Have to Pay Taxes on My Crypto Profits?

Yes. In most countries, including the United States, cryptocurrencies are treated as property for tax purposes. This means you will likely owe capital gains tax whenever you make a profit.

This happens more often than people think. You could trigger a taxable event when you:

- Sell your crypto for cash.

- Trade one cryptocurrency for another.

- Use crypto to pay for goods or services.

Tax laws can get complicated and are always evolving, so your best bet is to talk to a qualified tax professional to make sure you’re staying compliant. For more general questions, you can also check out the vTrader FAQ page for some helpful info.

Which Cryptocurrency Should I Buy First?

When in doubt, start with the titans of the industry: Bitcoin (BTC) and Ethereum (ETH).

They have the longest track records, the biggest market caps, and a massive amount of public research available. Kicking things off with these more established players lets you get comfortable with how the market moves before you even think about venturing into smaller, more speculative altcoins.

They simply offer a much more stable entry point into the exciting world of crypto.

Steve Gregory is a lawyer in the United States who specializes in licensing for cryptocurrency companies and products. Steve began his career as an attorney in 2015 but made the switch to working in cryptocurrency full time shortly after joining the original team at Gemini Trust Company, an early cryptocurrency exchange based in New York City. Steve then joined CEX.io and was able to launch their regulated US-based cryptocurrency. Steve then went on to become the CEO at currency.com when he ran for four years and was able to lead currency.com to being fully acquired in 2025.