Don't get fooled by flashy headline numbers. Picking a crypto exchange based on one fee alone can be a costly mistake. The true cost of trading is a cocktail of trading fees, withdrawal charges, and other hidden costs that can quietly eat into your profits.

A deep dive into a cryptocurrency exchange fees comparison shows a fascinating split. You have giants like Binance with their well-known low 0.1% trading fees, but then you have innovators like vTrader shaking things up with a genuine zero-fee model. Over time, that difference could save you a serious amount of money.

Why Crypto Exchange Fees Actually Matter

It’s easy to get lost in the maze of fee schedules, but those tiny percentages are the difference between a winning and losing strategy. It doesn't matter if you're a casual investor buying once a month or a high-frequency trader placing dozens of orders a day—these costs directly chip away at your returns.

Ignoring fees is like trying to fill a leaky bucket. You might be making great trades, but you're constantly losing value from a slow, steady drip.

The True Cost of Trading

The trading fee is the most obvious cost, but the gap between platforms is huge. Some exchanges, like Coinbase, can hit you with fees from 0.5% to over 1%. Others, like Binance, are famous for their much lower 0.1% rate.

What does that mean in real terms? On a $10,000 trade, you could pay $10 on one platform and over $100 on another. A detailed 2022 fee analysis highlights just how much these structures vary.

This gap gets even wider when you add in other costs like withdrawal fees—which can change with network congestion—or hidden charges like the spread. All these expenses add up to a "total cost" that most traders never stop to calculate.

The real challenge isn't just finding low fees; it's finding transparent fees. Many traders are shocked to discover how much of their portfolio has been eaten by charges they never saw coming, turning what should have been solid gains into frustrating losses.

A New Approach to Crypto Costs

This frustration is exactly what’s pushing the industry to evolve. Platforms like vTrader have been built from the ground up on a compelling zero-fee structure, getting rid of trading costs entirely.

This gives you a clear edge, letting you keep 100% of your trade's value. Instead of worrying about how fees will slice into every move, you can focus purely on your strategy.

This model is a game-changer for several types of traders:

- Frequent Traders: When you're making dozens or hundreds of trades, zero fees create massive savings.

- Small Investors: Every dollar counts. Zero fees ensure your starting capital isn’t instantly diminished.

- DCA Investors: For those making automated, regular buys, a zero-fee model keeps your strategy cost-effective without recurring percentage-based hits.

Getting a handle on these fee dynamics is your first step to becoming a sharper investor. To build on this knowledge, check out the free educational resources at the vTrader Academy.

Decoding The Four Types Of Exchange Fees

To make a smart cryptocurrency exchange fees comparison, you first have to know what you’re actually paying for. Exchanges often slice and dice these costs into confusing categories, but they really boil down to four main types. Once you get a handle on these, you can calculate the true cost of trading and stop watching your profits get chipped away.

Each fee has a different purpose and hits your portfolio in a unique way. Let's cut through the jargon and see what it means for your money, so you can pick apart any platform's fee schedule like a pro.

Trading Fees The Maker Taker Model

Trading fees are the most common charges you'll run into, popping up every time you buy or sell. Most exchanges operate on a maker-taker model, a system designed to keep the market flowing with orders.

- Maker Fee: This is what you pay when you place an order that isn't filled instantly, like a limit order to buy Bitcoin below its current price. Since your order adds liquidity to the market's order book, exchanges often give you a break with a lower fee.

- Taker Fee: This fee applies when your order is matched immediately with one that’s already on the books—think a market order to buy Bitcoin right now. You're "taking" liquidity away from the market, so you usually pay a little more.

For instance, Coinbase might hit you with a 0.4% maker fee and a 0.6% taker fee, while Binance could charge a flat 0.1% for both. Then you have platforms like vTrader, which just do away with maker and taker fees entirely. This simplifies things and means more of your investment stays yours from day one.

Deposit And Withdrawal Fees

While trading fees are a constant, deposit and withdrawal costs can be surprisingly steep, especially when you're moving your funds off an exchange.

Deposit fees aren't as common, but you might see them if you’re using specific methods like a wire transfer. The real kicker is the withdrawal fee, which exchanges charge to send your crypto to an external wallet. It might be a flat rate (like 0.0005 BTC) or a dynamic fee that fluctuates with network congestion. When the network gets busy, those fees can skyrocket.

A great trading fee can get completely wiped out by one expensive withdrawal. You have to look at the total cost of your journey—from putting money in to eventually securing your assets in cold storage.

Hidden And Ancillary Fees

This is where a lot of traders get blindsided. Hidden fees aren't always front and center on the main schedule, but they can eat into your bottom line. A thorough cryptocurrency exchange fees comparison has to dig these up.

- Spread: This is simply the gap between the buying price (ask) and the selling price (bid). Some so-called "zero-fee" platforms bake their profits into a wider spread, which means you're buying higher and selling lower than the actual market price.

- Slippage: This happens when your trade executes at a different price than you expected, usually because the market is moving fast. It's not a direct fee, but a platform with thin liquidity can cause you to lose more to slippage.

- Inactivity Fees: Some exchanges will charge you a monthly fee if your account goes dormant for a while.

- Margin and Lending Fees: If you're into margin trading or lending, you'll be paying interest on the funds you borrow.

Getting a grip on this full spectrum of costs is essential. For a transparent look at how a true zero-fee model works without these nasty surprises, you can check out the clear fee structure at vTrader. It’s built to get rid of the guesswork and help you maximize your returns.

Head-to-Head Cryptocurrency Exchange Fees Comparison

This is where the rubber meets the road. Talk is cheap, but a direct, numbers-based cryptocurrency exchange fees comparison uncovers the real cost of trading on different platforms. We’re putting industry giants like Binance, Coinbase, and Kraken in the ring together, stacking them up against vTrader's zero-fee model to show you exactly how much of your money is actually on the line.

To get practical, we’re not just going to throw percentages at you. Instead, we'll walk through some real-world trading scenarios to expose the tangible hit these fees can take on your portfolio. This isn't about abstract figures—it's about the total cost of using an exchange.

Trading Fees: The Real-World Impact

Let’s dive into the most common charge every trader runs into. The gap between a 0.6% fee and a 0.1% fee might look tiny at first glance, but trust me, it adds up faster than you’d think.

Imagine you’re ready to pull the trigger on a $1,000 Bitcoin trade. Here’s how that initial cost breaks down across different platforms, assuming you’re a standard user paying the taker fee:

- Coinbase: With a taker fee hovering around 0.6%, you're immediately out $6.00.

- Kraken: Their taker fee is a bit better at 0.4%, which will cost you $4.00.

- Binance: Known for its lower costs, their 0.1% taker fee amounts to a $1.00 charge.

- vTrader: Thanks to its zero-fee structure, your cost is a clean $0.

A few dollars might not sound like a dealbreaker on a single trade, but for anyone trading actively or using a dollar-cost averaging (DCA) strategy, these differences become massive over time.

Think about a DCA investor who puts $200 into crypto every month. Over a year, that’s a $2,400 investment. On Coinbase, they would have paid $14.40 in fees. On Binance, just $2.40. With vTrader, it stays at $0, which means every single dollar of their investment goes straight into the asset they’re buying.

The goal isn't just to save a few bucks on one trade; it's to build a cost-efficient system for your entire investment journey. Small, recurring fees are the silent portfolio killers that quietly eat away at your capital's growth potential.

Deposit And Withdrawal Fees: A Closer Look

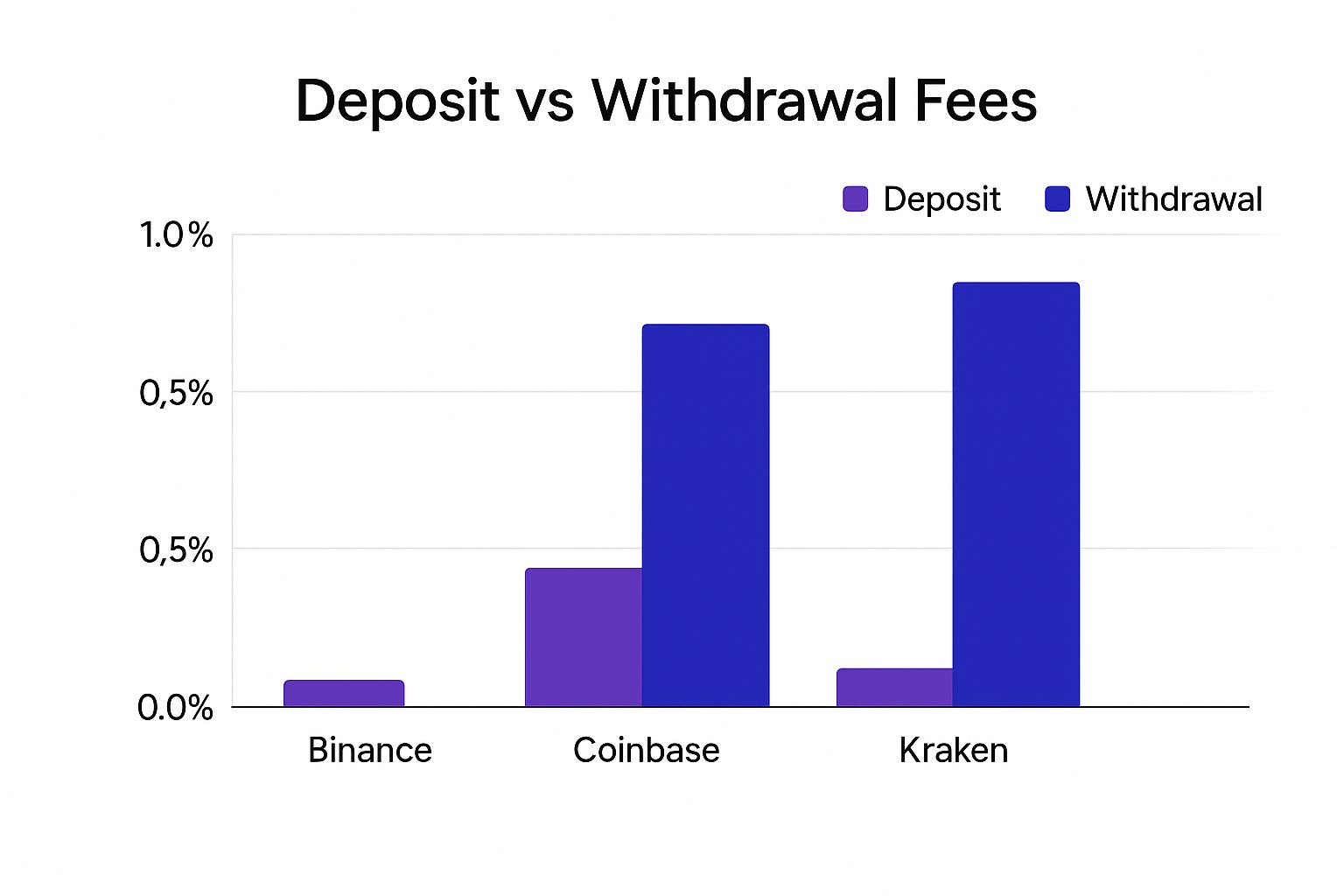

Trading fees are just one piece of the puzzle. Getting your money onto and off an exchange can tack on another layer of costs. The image below gives you a solid comparison of what you can expect for deposit and withdrawal fees at the major exchanges.

As the data shows, while some deposit methods might be free (like ACH transfers on Coinbase), withdrawal fees are nearly universal. They can also swing wildly depending on the crypto asset and how congested the network is at that moment.

This is a huge deal for investors who believe in self-custody and plan on moving their crypto to a personal wallet. An exchange might lure you in with low trading fees, only to hit you with a massive withdrawal charge when you decide to take control of your funds. It’s critical to look at the entire fee structure, not just the flashy trading rates.

Comprehensive Fee Comparison Across Major Crypto Exchanges

To tie it all together, here’s a detailed breakdown that compares trading fees, withdrawal examples, and other key features across popular exchanges. This table provides a clear, at-a-glance view to help you make an informed decision.

| Exchange | Maker Fee Range | Taker Fee Range | Example BTC Withdrawal Fee | Example ETH Withdrawal Fee | Key Fee-Related Features |

|---|---|---|---|---|---|

| vTrader | 0% | 0% | Network Fee Only | Network Fee Only | Truly zero-fee trading; transparent network pass-through on withdrawals. |

| Binance | 0.1% | 0.1% | ~0.0005 BTC | ~0.002 ETH | Offers a 25% discount if you pay fees with their native BNB token. |

| Coinbase | 0.4% | 0.6% | ~0.0001 BTC | ~0.003 ETH | Simple interface but higher fees for instant buys and smaller trades. |

| Kraken | 0.25% | 0.4% | ~0.0004 BTC | ~0.0035 ETH | Volume-based discounts are available but require significant trading activity. |

This cryptocurrency exchange fees comparison table really exposes the different philosophies at play. Traditional exchanges like Binance and Kraken push high-volume trading and the use of their own tokens to bring costs down. Coinbase shoots for simplicity, but that convenience often comes with a higher price tag for its users.

In stark contrast, vTrader cuts through all that complexity. By offering a 0% trading fee for every user, regardless of how much they trade, it levels the playing field for everyone. This model is a game-changer for several types of investors:

- New Investors: You can start your journey without watching your initial capital get chipped away by fees.

- Strategic Traders: You can run complex strategies with tons of small trades without worrying about the costs piling up.

- Long-Term Holders: You can accumulate assets over time without those pesky recurring charges, only paying the base network fee when you decide to withdraw.

Ultimately, the best exchange comes down to your personal trading style, but understanding the total cost of ownership is non-negotiable. Platforms with complex, tiered fee schedules force you to constantly watch your back to make sure you're getting a good deal. A zero-fee model, on the other hand, offers a straightforward and consistently cheap alternative, letting you focus on what really matters: your investment strategy.

The Hidden Costs of Withdrawal And Network Fees

A fantastic trading fee can sometimes be a clever marketing trick. A detailed cryptocurrency exchange fees comparison often reveals a painful truth many investors learn the hard way: what you save on trades can vanish when you try to move your assets. These withdrawal and network fees are the hidden icebergs that can sink an otherwise cost-effective trading strategy.

These costs aren't always fixed or predictable, as they're directly tied to the blockchain's current activity. When a network like Bitcoin or Ethereum gets jammed with high transaction volume, the cost to get a transaction confirmed—the network fee—can spike dramatically. Many exchanges pass this volatile cost straight to you, sometimes tacking on their own administrative charge.

How Exchanges Handle Withdrawal Costs

When you decide to pull your crypto to a personal wallet for self-custody, exchanges handle the fees in a few different ways. This is a critical point of comparison that many new traders miss.

- Flat-Rate Fees: Some platforms slap a standardized fee on each crypto withdrawal, no matter the network conditions. For instance, an exchange might always charge 0.0005 BTC to withdraw Bitcoin. This can be a good deal when the network is expensive but a ripoff during quiet times.

- Dynamic Fees: Other exchanges pass the real-time network fee directly to you. It's a more transparent approach, but it introduces wild unpredictability. A withdrawal that costs $5 today could easily cost $50 next week.

- Flat Rate Plus Network Fee: In what's often the worst model, an exchange charges its own fixed fee on top of the dynamic network cost, effectively double-dipping on your withdrawal.

This is where a platform like vTrader sets itself apart. By only passing through the direct network fee without adding extra charges, it creates a much more transparent and honest withdrawal process. You only pay what's necessary to get your transaction processed on the blockchain, period.

The Real-World Impact of Network Volatility

The history of Bitcoin transaction fees is a stark lesson in just how unpredictable these costs are. Fees have fluctuated wildly since 2009, all driven by network demand. During the 2017 crypto boom, for example, average Bitcoin transaction fees shot up to over $50, making small transfers economically pointless. While fees fell after that peak, they remained volatile, climbing back to around $15 right before the 2024 halving. You can dig deeper into these trends and their impact on traders with detailed industry stats. Read more about the volatile history of Bitcoin transaction fees on Statista.com.

A trader might save $10 on a trade using a "low-fee" exchange, only to get slammed with a $25 withdrawal fee a week later. This completely negates the initial savings and hammers home the importance of evaluating the entire fee structure, not just the advertised trading rates.

This volatility creates a real dilemma for security-conscious investors. The best practice is to move assets off exchanges and into personal wallets, but high and unpredictable withdrawal fees can punish you for it. A trader might feel forced to leave funds on an exchange longer than they'd like—increasing their exposure to platform-specific risks—just to avoid getting hit with an outrageous fee.

Ultimately, a complete cryptocurrency exchange fees comparison has to go beyond the trade itself. Analyzing how a platform handles withdrawals is just as important. Platforms that absorb their own administrative costs and offer a transparent pass-through of network fees, like vTrader, give users a more predictable and fair experience, ensuring that smart trading decisions aren't undone by hidden exit costs.

Matching An Exchange To Your Trading Strategy

A deep-dive cryptocurrency exchange fees comparison does more than just show you which platform is cheapest—it reveals which one is smartest for your specific approach. There's no one-size-fits-all answer here. The right exchange depends entirely on your trading frequency, how long you plan to hold your assets, and your overall strategy. Getting this wrong is like picking running shoes for a swimming competition; it just doesn't work.

Let’s break down three common investor profiles to see how different fee models can make or break their profitability. You'll quickly see why a zero-fee structure offers a powerful edge for everyone.

The Active Day Trader

For the active day trader, success is a game of inches, won or lost on fractions of a percent. These traders are all about high volume and high frequency, jumping in and out of multiple positions in a single day to ride short-term market waves. For them, trading fees aren't just a nuisance—they're the single biggest operational cost.

Imagine a trader executing 20 trades a day, each valued at an average of $500.

- On an exchange with a 0.1% taker fee, they’re paying $0.50 per trade. That quickly adds up to $10 a day, or around $2,400 over a year of consistent trading.

- Now, picture an exchange charging a 0.6% taker fee. The cost per trade jumps to $3.00, ballooning into $60 a day and a staggering $14,400 annually.

For this type of trader, a zero-fee model like vTrader’s isn’t just a nice-to-have; it's a game-changer. Wiping out trading fees means 100% of those costs go straight back into their pocket, protecting the very slim margins they fight so hard to secure.

The Long-Term HODLer

The "HODLer" is your classic buy-and-hold investor. They make larger, less frequent purchases with every intention of holding onto their assets for months, if not years. Their main concern isn't the maker-taker fee on a single trade, but the total cost of getting their assets and, down the line, moving them to safety.

For the long-term investor, the initial purchase cost and the final withdrawal fee are the two most critical checkpoints. High fees at these stages can significantly eat into the total amount of crypto they accumulate and eventually secure in self-custody.

Let’s say a HODLer wants to invest $10,000 into Ethereum. A 0.6% trading fee ($60) is a noticeable one-time hit, but the real sting often comes when they decide to move their ETH to a private wallet. They could get slammed with a hefty withdrawal fee, especially when the network is busy.

A zero-fee platform gives them an immediate advantage by maximizing their buying power from day one. They can scoop up more ETH with their $10,000 right from the start, positioning them for potentially greater gains over the long haul.

The Automated DCA Investor

The Dollar-Cost Averaging (DCA) investor is all about discipline and consistency. This person sets up recurring, automated buys—say, $100 every Friday—to steadily build their position and smooth out the bumps from market volatility. For them, recurring fees are the silent killer of returns.

Here’s a look at how a weekly $100 DCA strategy plays out over one year (a $5,200 total investment):

- Platform with 0.6% Fee: Each $100 purchase gets hit with a $0.60 fee. Annually, that’s $31.20 in capital that never even made it into the market.

- Platform with 0.1% Fee: Each buy costs $0.10. The annual fee is a much more palatable $5.20.

- vTrader (Zero-Fee): The cost is $0. Every single dollar is put to work acquiring the asset.

While $31.20 might not sound like a fortune, it's money that should have been compounding. For someone whose entire strategy is built on steady accumulation, cutting out these small but persistent fees ensures their disciplined approach is as powerful as it can be. The team behind vTrader gets this—you can learn more about their story and what drives their user-first philosophy.

How vTrader's Zero-Fee Model Is Changing Crypto

In a market where every click can cost you, vTrader’s zero-fee model isn't just a small change—it’s a complete overhaul of how we trade crypto. This isn't about offering a temporary discount. It’s about tearing down the single biggest wall that keeps many people from getting started and turning a profit. By scrapping trading fees entirely, vTrader ensures your strategy alone dictates your success, not the platform's cut.

The whole thing is powered by a straightforward business model that focuses on providing real value, not by chipping away at your capital with endless fees. This approach builds a foundation of trust and puts more money back in your pocket. It simplifies your tax reporting and means you can stop wrestling with complex fee calculators—a huge win for anyone doing a serious cryptocurrency exchange fees comparison.

Redefining Value For The Modern Trader

The zero-fee approach stands in stark contrast to the eye-watering costs you see elsewhere in crypto. To put it in perspective, the Ethereum network was burning through around $6.7 million a day in fees in mid-2022. Big-name decentralized exchanges like Uniswap were pulling in over $2.3 million daily from users. You can see more on how network activity drives user costs at CryptoFees.info. Those numbers show just how much financial friction exists in this space.

By taking on those trading costs, vTrader lets you bypass that part of the game entirely. This is a massive advantage for active day traders and anyone using strategies like dollar-cost averaging, where those small, recurring fees can quietly eat away at your long-term returns.

vTrader’s mission is to democratize access to digital assets by removing cost as a primary obstacle. We believe that a trader's success should be determined by their strategy and market insight, not by their ability to overcome prohibitive fees.

This isn't just marketing fluff; it's a core structural advantage. It cements the platform as a true innovator in the ever-changing world of digital asset exchanges—an evolution you can track through the official vTrader news updates. By creating a truly free trading environment, vTrader gives you the power to engage with the market on your terms, knowing every cent you invest is working for you.

Frequently Asked Questions About Crypto Fees

Even after diving deep into a cryptocurrency exchange fees comparison, it's natural to have a few questions left. Let's tackle some of the most common ones to clear up any lingering doubts you might have.

How Can Some Exchanges Offer Zero Fees?

It sounds too good to be true, but it's a legitimate business model. Exchanges that offer zero-fee trading don't just eat the cost; they simply make money in other ways.

Instead of nickel-and-diming every trade, these platforms might generate revenue through things like payment for order flow, earning yield on customer assets, or offering premium services for power users. This approach allows exchanges like vTrader to completely ditch trading fees for everyone, which builds a lot more trust than hiding costs in a complicated fee schedule.

Are Low Fee Exchanges Always The Cheapest?

Not by a long shot. An exchange can lure you in with a low trading fee, only to hit you with sky-high costs elsewhere. It all comes down to total cost.

Think about it: a platform with a 0.1% trading fee might seem cheap, but if it charges a fortune for withdrawals or has a massive bid-ask spread, you could end up paying way more. It's the entire journey, from deposit to withdrawal, that counts.

The cheapest exchange isn't the one with the flashiest trading fee. It's the one that costs you the least from start to finish. Don't get distracted by one good number; look at the whole picture.

What Is The Best Way To Minimize Crypto Fees?

You can definitely play the system to cut down on costs. Some traders focus on being a 'maker' to snag lower fees, while high-volume traders hunt for exchanges with discounts.

But honestly, the most straightforward strategy is to pick a platform like vTrader that’s built from the ground up with a low or zero-fee structure. If you want more no-nonsense answers, check out our detailed vTrader FAQ page.

Ready to stop overpaying and start maximizing your returns? Join vTrader today and experience the power of truly zero-fee trading. Get started now and claim your sign-up bonus!

Steve Gregory is a lawyer in the United States who specializes in licensing for cryptocurrency companies and products. Steve began his career as an attorney in 2015 but made the switch to working in cryptocurrency full time shortly after joining the original team at Gemini Trust Company, an early cryptocurrency exchange based in New York City. Steve then joined CEX.io and was able to launch their regulated US-based cryptocurrency. Steve then went on to become the CEO at currency.com when he ran for four years and was able to lead currency.com to being fully acquired in 2025.