So, you’re ready to turn your crypto profits into actual cash in your bank account. It's a common goal, and thankfully, the process is pretty straightforward once you get the hang of it. The most popular path involves using a trusted exchange like vTrader to convert your digital coins into fiat currency (like USD or EUR) and then sending it over to your bank.

At its core, this boils down to three distinct stages: getting your crypto onto the exchange, selling it for cash, and then withdrawing that cash.

Your Roadmap for Cashing Out Crypto

Before we dive into the nitty-gritty, let's look at the big picture. Think of this as your high-level map for the journey from your crypto wallet to your bank account. We'll be using vTrader for our examples, but you'll find these fundamental steps are nearly identical across most major platforms.

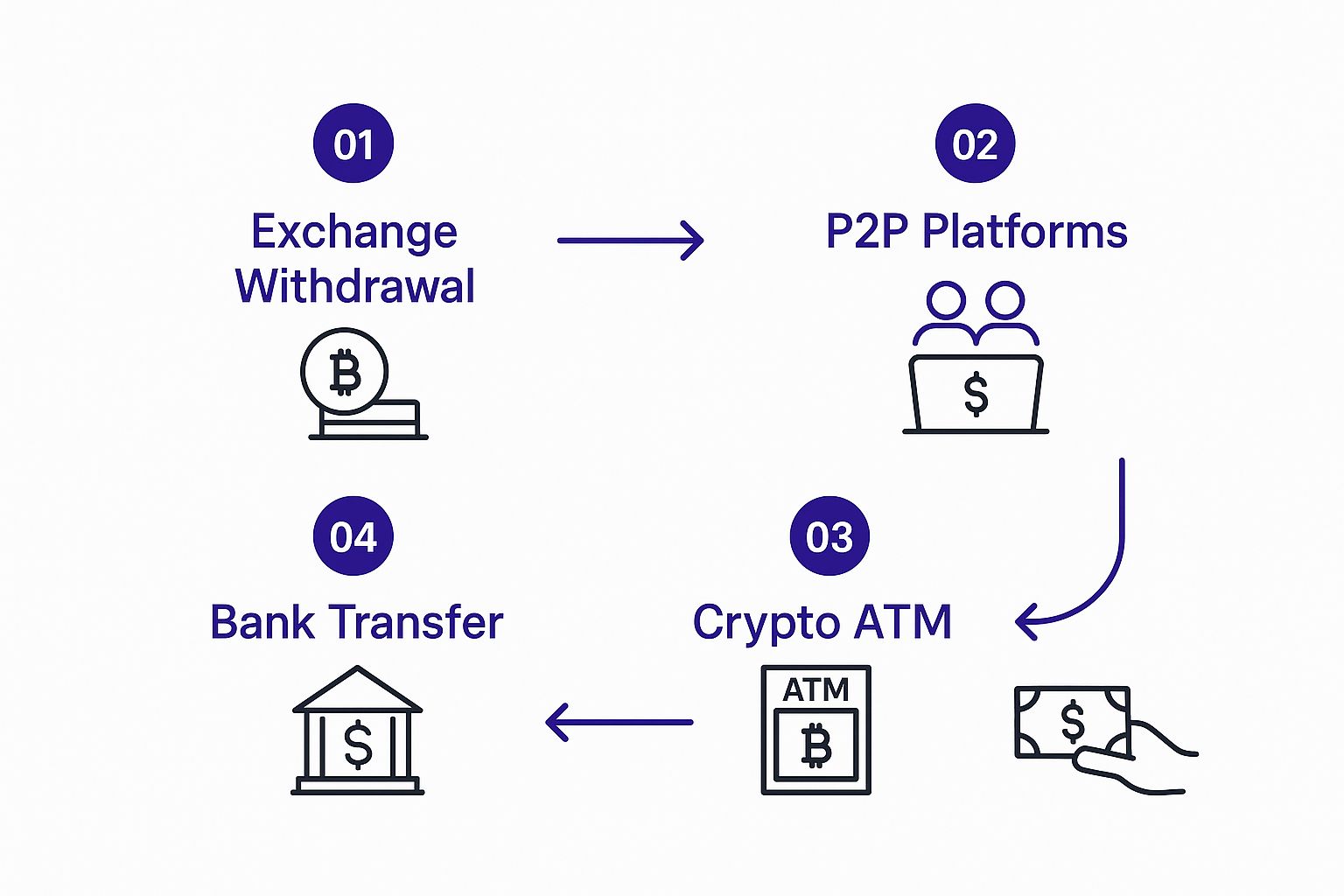

This chart gives you a clear visual of the main routes for turning digital assets into spendable money.

As you can see, a centralized exchange is your most direct line to a bank transfer. It strikes a great balance, offering a reliable bridge between peer-to-peer sales and more complex withdrawal methods.

The Three Core Stages of Cashing Out Crypto

To make it even clearer, let's break down the entire process into three essential actions. This is the fundamental sequence you'll follow on vTrader or any similar platform.

| Stage | Action Required | Key Consideration |

|---|---|---|

| Stage 1: The Deposit | Move your cryptocurrency from a private wallet to your vTrader account. | Ensure you're sending the correct crypto on the right network to avoid losing funds. |

| Stage 2: The Sale | Place an order on the exchange to sell your crypto for a fiat currency (e.g., selling BTC for USD). | Market timing and fees will impact the final amount of cash you receive. |

| Stage 3: The Withdrawal | Initiate a transfer of the fiat currency from your vTrader account to your linked bank account. | Verification levels and bank processing times will determine how quickly you get your money. |

This three-stage flow—deposit, sell, withdraw—is the standard operating procedure in the crypto world. Major exchanges have refined this process to handle billions in daily volume, making it both fast and liquid.

If you want to sharpen your market knowledge before you sell, the vTrader Academy is an excellent resource. Check out our guide on trading fundamentals to help you make more informed decisions.

Every step has details that can affect your final payout. Our goal here is to give you the confidence and know-how to handle each stage like a pro. In the following sections, we’ll break down this entire journey piece by piece.

Setting Up Your vTrader Account for Withdrawals

Before you even think about cashing out your crypto, you need to lay some serious groundwork. Your vTrader account is the bridge between your digital holdings and your bank account, so setting it up right from the start is absolutely critical. While the initial sign-up is a breeze, the real work—and the real security—comes from proper verification and authentication.

This isn’t just about ticking boxes; it's a fundamental process that ensures your funds are locked down tight and that vTrader stays on the right side of financial regulations. It’s a step that protects you and the entire trading ecosystem.

Why Verification Is Non-Negotiable

You're going to come across a process called Know Your Customer (KYC). I know, it can feel like a bit of a drag, but it's a security measure that financial authorities around the world insist on for a good reason. It’s all about preventing fraud and illegal activities by making sure you are who you say you are.

For you, this means a much safer place to trade. For vTrader, it means staying compliant and protecting the market's integrity. Regulators like the UK's Financial Conduct Authority are clear that these standards are what build a trusted, long-lasting crypto sector.

Getting through KYC is pretty straightforward if you're prepared. You’ll generally need a couple of things:

- A government-issued ID: Your driver's license, passport, or national ID card will do the trick. Just make sure it hasn't expired and the picture is crisp and clear.

- Proof of address: A recent utility bill or a bank statement usually works best. It needs to be less than three months old and clearly show your full name and address.

A little pro-tip from experience: have these documents ready before you even start. I always suggest snapping clear, well-lit photos of them with your phone. That way, when the platform asks for them, you can upload them in seconds and keep the process moving.

Securing Your Account with 2FA

As soon as your account is live, your very first move should be to enable Two-Factor Authentication (2FA). This is, without a doubt, your best line of defense against anyone trying to get into your account. Even if a hacker somehow gets your password, they're stopped dead in their tracks without that second verification code.

vTrader supports authenticator apps like Google Authenticator or Authy, which are miles more secure than getting codes via SMS. During setup, you'll get a secret key or a QR code.

This is important: write down this secret key and store it somewhere safe and offline. Seriously. If you lose your phone, this key is your only lifeline to get back into your 2FA and, by extension, your account. Following these steps ensures you're aligned with the best security practices, which is a key part of your responsibility as a user. You can read more about it in the vTrader terms and conditions to get the full picture.

Connecting and Verifying Your Bank Account

Alright, with your vTrader account locked down and secure, it’s time to build the bridge back to your bank. This is the crucial link that lets you turn your crypto profits into real-world cash—the USD or EUR you can actually spend. We’ve made this process as painless and secure as possible, giving your money a clear, verified path home.

The exact method you’ll use will hinge on where you are in the world. For instance, traders in the United States will typically use ACH (Automated Clearing House) transfers. Over in Europe, the standard is SEPA (Single Euro Payments Area). Both are time-tested, reliable networks for moving funds between financial institutions.

Linking Your Withdrawal Method

Jump into your vTrader profile, and you'll spot a section for withdrawal methods or linked bank accounts. The platform taps into modern, secure services like Plaid to make this connection seamless. You’ll just pick your bank from a list and securely log in with your usual online banking details.

This integration does the heavy lifting for you by automatically fetching your account and routing numbers. It’s a huge timesaver and, more importantly, it nearly eliminates the risk of a typo sending your money into the void. We take the security of this data seriously; you can get the full rundown on how your information is protected by reading the vTrader privacy policy.

If you’re just starting out and don't have a crypto-friendly bank account yet, checking out this list of top banks that accept ITINs can be a big help. It can make the whole setup process for crypto withdrawals much smoother.

The Verification Process

Once you’ve linked your account, there’s one more hoop to jump through: verification. This is a standard security measure across the financial world to confirm you actually own the bank account you’ve connected. It’s a simple step that goes a long way in preventing fraud and protecting your funds.

A common way we do this is with micro-deposits. vTrader will send two tiny, random deposits—we’re talking just a few cents—to your bank account. These usually take a business day or two to show up.

When you spot those little deposits on your statement, head back to vTrader and plug in the exact amounts. That's the final key to unlocking your withdrawals and getting your cash out.

Here are a few pro tips to make sure it all goes smoothly:

- Double-check your login: A simple typo in your banking username or password is the most common hiccup. Take a second to get it right.

- Patience is a virtue: Remember, ACH and SEPA networks aren't instant like crypto. Give it a couple of business days for the micro-deposits to land before you start worrying.

- Know your limits: Your verification level sets your daily or monthly withdrawal caps. Keep these numbers in mind as you map out your cash-out strategy.

Once you’re verified, you are officially good to go. You’re all set to sell your crypto and pull your cash out whenever you need it.

How to Sell Crypto and Withdraw Cash on vTrader

Alright, this is where theory turns into reality. With your account locked down and your bank linked up, you’re ready for the main event: turning your digital assets into cold, hard cash. Think of this as your personal playbook for moving crypto into vTrader, executing the perfect sell, and pulling your money out.

Safely Depositing Your Crypto

First things first, you need to get your crypto into your vTrader account. Whether it's coming from a hardware wallet or another exchange, this is a step where you want to be precise. One wrong move here can be a costly mistake.

Inside your vTrader wallet, find and select the cryptocurrency you plan to move—let's say it's Bitcoin (BTC) or Ethereum (ETH). vTrader will generate a unique deposit address just for that coin.

Crucial Tip: I can't stress this enough—always send a small test transaction first. Before you move your entire stack, send a tiny fraction to the new address. Make sure it lands safely in your vTrader account, then you can send the rest. It’s a simple precaution that has saved countless people from major losses.

Pay close attention to the network, too. Sending your ETH on the wrong one, like using Binance Smart Chain instead of the main Ethereum network, is a one-way ticket to lost funds. vTrader is good about making this clear, so always double-check that you’ve selected the correct network before hitting send.

Choosing Your Selling Strategy

Once your crypto arrives, it's time to sell. vTrader offers two main ways to do this: a market sell or a limit sell. The right choice really boils down to what you value more at that moment: speed or price.

- Market Sell for Speed: This is your fastest, no-fuss option. A market order sells your crypto instantly at the best price currently available. If you just need cash now and aren’t sweating minor price dips, this is the way to go.

- Limit Sell for Price Control: A limit order puts you in the driver's seat. You set the exact price you’re willing to sell at, and the order only goes through if the market hits that number. It’s perfect when you have a specific target in mind and you’re not in a rush.

For instance, say Bitcoin is hovering around $60,000, but you’re confident it’ll touch $61,000. You can place a limit sell order at $61,000. Your BTC will only be sold when the price climbs to your target, but there's no guarantee it will ever execute if the market moves against you.

Initiating the Final Withdrawal

With your sell order filled, the fiat currency—like USD or EUR—will pop up in your vTrader cash balance. Now for the final step: getting that money into your bank account.

Just navigate to the withdrawal section, pick your linked bank account, and punch in the amount you want to transfer. You'll likely need to approve the transaction with your 2FA app, a quick but essential security measure. Once confirmed, the process begins.

Remember that fees will affect your final total. For a full breakdown of what to expect, you can check out vTrader’s transparent fee structure.

Be patient with withdrawal times. Standard bank transfers like ACH or SEPA aren't instant; they usually take 1-3 business days to land in your account. vTrader will give you an estimated arrival date and send you updates along the way.

Exploring Alternative Ways to Cash Out Crypto

While using a centralized exchange like vTrader is often the most direct route for turning your crypto into cash, it’s certainly not the only game in town. Depending on your needs—whether it's speed, privacy, or just navigating local regulations—exploring a few other avenues can give you a lot more flexibility.

Honestly, knowing these alternatives isn't just about preference; for many people, it’s a flat-out necessity. This is especially true when it comes to peer-to-peer platforms.

Peer-to-Peer (P2P) Platforms

Think of P2P platforms as a digital marketplace, directly connecting people looking to sell crypto with those who want to buy it. It’s a bit like a Craigslist or eBay for digital currency, but with the crucial addition of security features like escrow services to protect both sides of the deal.

This method has become a lifeline in parts of the world where traditional banks don't play nice with crypto exchanges or where regulations make cashing out a nightmare. Peer-to-peer (P2P) trading is a dominant force in these areas, accounting for a massive 10-15% of total crypto liquidity in emerging markets. If you want to dive deeper, you can find more on how P2P fits into modern crypto cash-out strategies.

Here’s a real-world example: Imagine you’re in a country with tight capital controls. A direct withdrawal from a big exchange might get blocked or raise red flags. With a P2P platform, you could sell your Bitcoin to someone in your country and get paid through a simple local bank transfer or even a popular mobile payment app, sidestepping the international banking system entirely.

Of course, that flexibility comes with a trade-off. You’re dealing directly with another person, not a massive company, which introduces counterparty risk. My advice? Always stick to trading with users who have a high rating and a long, proven history of successful transactions. Don't take chances.

Crypto Debit Cards

Another game-changer that's been gaining serious traction is the crypto debit card. These cards, often backed by major players like Visa or Mastercard, link right to your crypto wallet. This means you can skip the whole process of selling on an exchange and spend your assets directly.

It works just like you'd hope:

- At the Checkout: When you swipe your card at a store, the provider instantly converts just enough of your crypto into fiat to cover the purchase.

- At the ATM: You can also just walk up to a standard ATM and pull out local cash directly from your crypto holdings.

The convenience here is incredible. It makes your crypto as spendable as the money in your regular bank account. For anyone who wants to use their digital assets for day-to-day expenses without the usual hoops, it's a fantastic solution.

Comparing Your Crypto Cash-Out Options

Deciding on the best way to turn your crypto into cash really depends on what you value most—speed, low fees, convenience, or privacy. Centralized exchanges are the default for a reason, but P2P platforms and crypto debit cards offer compelling advantages in specific situations. Here’s a quick breakdown to help you weigh your options.

| Method | Best For | Key Advantage | Main Drawback |

|---|---|---|---|

| Centralized Exchanges (CEX) | Beginners, large-volume traders, and those seeking simplicity. | High liquidity, straightforward process, and robust security. | Strict KYC requirements and potential for banking restrictions. |

| Peer-to-Peer (P2P) Platforms | Users in regions with banking friction or those seeking more payment options. | Incredible flexibility in payment methods and greater privacy. | Higher counterparty risk and potentially slower transaction times. |

| Crypto Debit Cards | Anyone wanting to spend crypto on everyday purchases or withdraw cash easily. | Unmatched convenience; spend crypto as easily as fiat. | Can have higher fees (conversion, ATM) and spending limits. |

Ultimately, there's no single "best" method—the right choice is the one that fits your specific needs at that moment. Many experienced users, myself included, use a combination of all three depending on the situation.

Common Questions on Cashing Out Cryptocurrency

Even with the clearest roadmap, it's natural to have a few questions swirling in your head. Turning digital assets back into cash can feel a bit tangled at first, especially when you factor in fees, taxes, and timing.

Let's cut through the noise and tackle some of the most common questions we see. Getting these answers straight will give you the confidence to move your funds smoothly and without any unwelcome surprises.

What Fees Should I Expect When Cashing Out?

"Fees" aren't just one single charge. Think of it as a series of small costs that happen along the way. Knowing what they are ahead of time means you won't be caught off guard when the final amount lands in your bank account.

You’ll typically run into three kinds of fees:

- Exchange Fees: This is what the platform charges you for the sale itself. vTrader is a commission-free exchange, which is a massive plus, but many other platforms will take a percentage of your trade value.

- Network Fees: When you send crypto to an exchange from an outside wallet, you'll pay a network fee (often called a "gas fee" on Ethereum). This fee goes to the blockchain miners or validators and has nothing to do with the exchange.

- Withdrawal Fees: This is the charge for sending your cash from the exchange to your bank. It’s usually a flat fee designed to cover the cost of the bank transfer itself.

It’s a lot like selling something on an online marketplace. You might pay a listing fee, a shipping fee, and a payment processing fee. The concept is the same here, just for digital assets.

How Long Until the Cash Is in My Bank Account?

This is where a little patience goes a long way. Crypto transactions can happen in a flash, but the traditional banking system still operates on its own, slower schedule. Once you hit "withdraw" on vTrader, the money has to make its way through old-school networks like ACH or SEPA.

You can generally expect the funds to show up in your bank account within 1 to 3 business days. Keep in mind that weekends and public holidays can tack on extra time, so it's always smart to plan ahead if you need the cash by a specific date.

A key takeaway here is to always double-check the estimated arrival time vTrader shows you during the withdrawal confirmation. It gives you a realistic timeline and helps you manage your finances without the stress.

Do I Have to Pay Taxes When I Cash Out Crypto?

In most places, including the United States, the answer is a definitive yes. Cashing out your crypto by selling it for fiat currency like dollars or euros is considered a taxable event. When you sell, you officially realize either a capital gain or a capital loss on that investment.

Put simply, if you sold your crypto for more than what you paid, that profit is typically viewed as taxable income. The exact tax rate you'll pay depends on factors like how long you held the asset and your total income. For more general questions, you can always check out the vTrader FAQ page.

Since tax laws can be incredibly complex and change based on where you live, it is highly recommended that you speak with a qualified tax professional. They’re the only ones who can give you tailored advice for your specific financial situation and make sure you’re staying compliant.

Is It Possible to Cash Out Without an Exchange?

Absolutely. While using an exchange like vTrader is the most common and often easiest route, it's definitely not your only play. One of the most popular alternatives gaining serious traction is the crypto debit card. These cards are a huge leap forward, letting you spend your digital assets directly at millions of stores worldwide without having to manually sell them for cash first.

Other methods are out there, too:

- Peer-to-Peer (P2P) Platforms: You can sell your crypto directly to another person.

- Crypto ATMs: These machines are popping up in more cities, allowing you to swap crypto for physical cash on the spot.

While these alternatives offer more flexibility, they often come with their own set of trade-offs, like much higher fees, less liquidity, or different security considerations.

Ready to cash out with confidence and zero trading fees? vTrader offers the most cost-effective way to convert your crypto into cash, backed by advanced security and a seamless user experience.

Start trading commission-free on vTrader today!

Steve Gregory is a lawyer in the United States who specializes in licensing for cryptocurrency companies and products. Steve began his career as an attorney in 2015 but made the switch to working in cryptocurrency full time shortly after joining the original team at Gemini Trust Company, an early cryptocurrency exchange based in New York City. Steve then joined CEX.io and was able to launch their regulated US-based cryptocurrency. Steve then went on to become the CEO at currency.com when he ran for four years and was able to lead currency.com to being fully acquired in 2025.