Diving into crypto can feel like learning a whole new language. I've seen countless beginners get stuck before they even start. The trick? Don't try to master everything at once. The quickest way to begin is to pick a trusted platform like vTrader, set up your account, and make a small first buy. It's all about starting small and learning as you go.

Getting Started Without Getting Overwhelmed

Jumping into the crypto world doesn't have to be intimidating. The real secret is to cut through all the noise and focus only on what matters for a beginner. Forget the complex trading charts and those "get rich overnight" stories for now.

Your first mission is simple: get a handle on the basic ideas that give cryptocurrencies their value. Think of it less like a casino and more like an investment in a new wave of financial tech. The market's potential is massive; the crypto space was valued at USD 2.48 billion in 2024 and is on track to hit USD 2.87 billion in 2025. This kind of growth is exactly why a long-term mindset is your best friend.

Understanding the Crypto Landscape

When you're just starting, the crypto world really boils down to two main categories you need to know:

- Bitcoin (BTC): This is the original, the one that started it all. Many people call it "digital gold." It's the most established and widely held, which makes it a common and sensible starting point for newcomers. It’s generally more stable than the smaller coins.

- Altcoins: This is just a catch-all term for every other crypto besides Bitcoin. It includes major players you've probably heard of, like Ethereum (ETH), but also thousands of smaller, more speculative projects.

My advice? Build a solid foundation with established assets like Bitcoin and Ethereum before you even think about the riskier altcoins. Your initial goal should be learning the ropes—how to buy, sell, and secure your assets—not chasing a 100x return.

A long-term view helps you stomach the market’s inevitable ups and downs without panic-selling. I know many new investors worry about volatility, but if you start with an amount you're genuinely comfortable losing, you can learn the process without all the stress. This transforms that initial anxiety into confident, informed action.

For a more structured path, the vTrader Academy is an excellent resource with modules designed to walk you through these fundamentals.

To make things even clearer, I've put together a simple checklist to guide your first moves. Think of this as your road map to getting started the right way.

Your Quick Start Crypto Investment Checklist

| Action | Why It's Important for Beginners | Recommended First Step |

|---|---|---|

| Choose a User-Friendly Exchange | A simple interface reduces overwhelm and the chance of making costly mistakes. | Create an account on a platform like vTrader, known for its beginner-friendly design. |

| Secure Your Account | Your crypto is only as safe as your account. Strong security is non-negotiable. | Enable Two-Factor Authentication (2FA) immediately after signing up. |

| Start with Major Coins | Established cryptocurrencies like Bitcoin and Ethereum are less volatile than smaller altcoins. | Make your first small investment in Bitcoin (BTC) or Ethereum (ETH). |

| Invest Only What You Can Afford to Lose | This is the golden rule of crypto. It removes emotion and stress from your decisions. | Decide on a small, fixed amount for your first purchase (e.g., $50 or $100). |

| Adopt a Long-Term Mindset | Day trading is for experts. Focusing on long-term growth helps you ignore short-term price swings. | Plan to hold your initial investment for at least one year. Don't check the price every five minutes. |

Following these steps will give you a solid, low-stress entry into the crypto market. It’s all about building good habits from day one.

Setting Up Your First Crypto Account

Alright, this is where the rubber meets the road. Setting up your account on an exchange like vTrader is how you officially step into the crypto arena. It's a pretty simple process, but you'll want to pay close attention to get everything right from the start. Think of it as laying a solid foundation before you start building your portfolio.

You'll kick things off with the usual stuff: name, email, and a password you won't forget (but that no one else could guess). That part’s fast, but what comes next is absolutely critical for keeping your account secure.

Verifying Your Identity

You'll need to go through what's called Know Your Customer (KYC). This just means uploading a photo of a government-issued ID, like your driver's license. I know, it can feel like a bit of a hassle. But this is a non-negotiable step for any regulated exchange like vTrader. It's a massive deterrent for fraud and keeps the entire platform in line with financial regulations, which ultimately protects everyone's money.

Once your ID is approved, the final step is linking a payment method, like your bank account. vTrader uses secure connections to handle all this, so you can transfer funds without worry.

Pro Tip: Before you do anything else, turn on Two-Factor Authentication (2FA). Seriously. Use an app like Google Authenticator. It adds a powerful layer of security that makes it incredibly difficult for anyone to get into your account, even if they somehow steal your password.

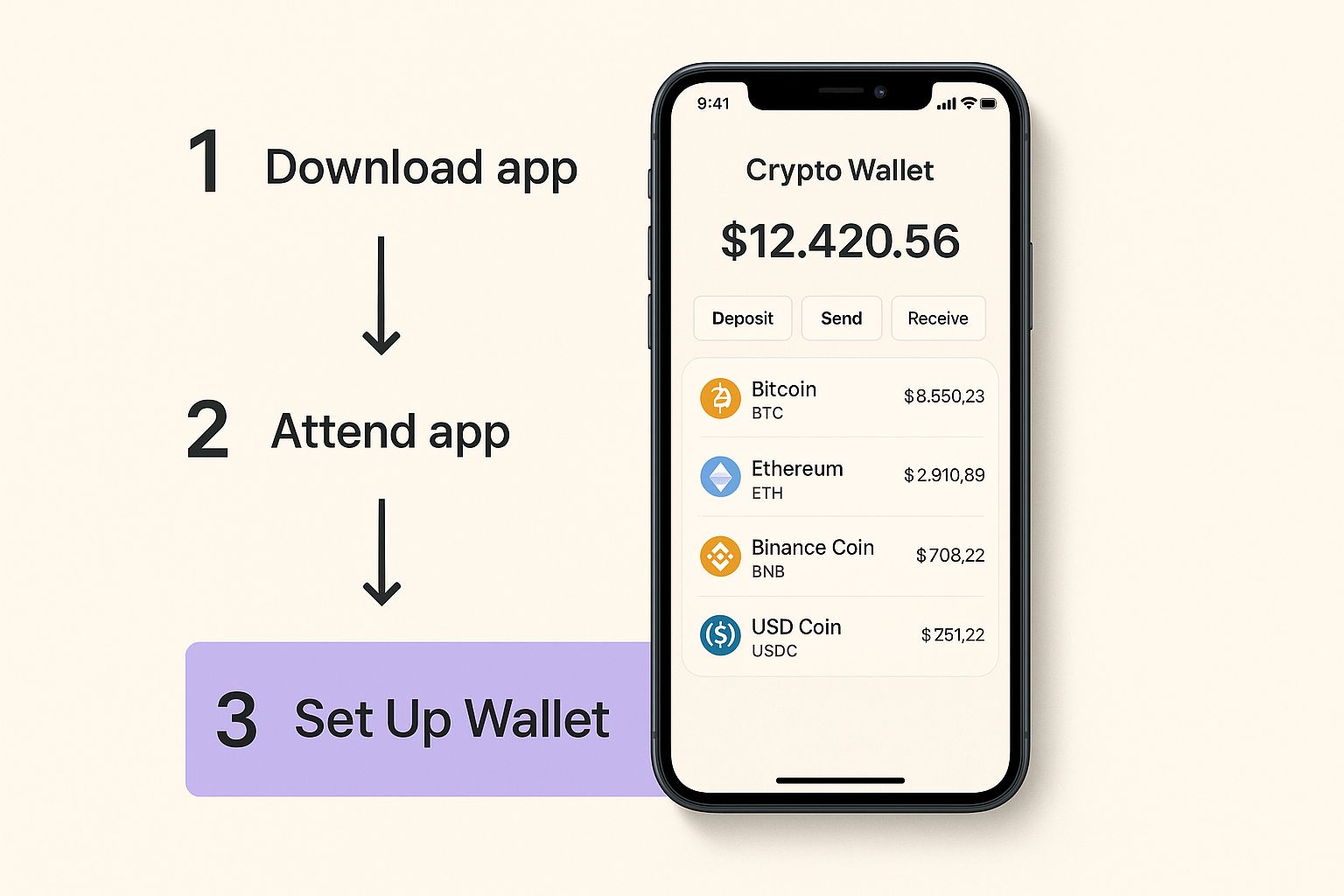

This image breaks down what that initial setup looks like on most crypto apps.

As you can see, the process is designed to be straightforward, walking you from sign-up to a fully secured account.

With these steps done, your account is live, protected, and ready for you to make your first trade. It’s also smart to get familiar with the fee structure ahead of time. You can check out the full vTrader fee schedule to see exactly what costs are involved with buying and selling.

Making Your First Crypto Purchase

Alright, let’s talk about pulling the trigger on your first crypto buy. This is a big moment, and my goal is to make sure you feel confident, not confused. The single most important piece of advice I can give you is this: only invest what you're prepared to lose. We're not trying to get rich quick here; we're focused on learning the ropes with as little risk as possible.

Let's walk through a real-world example. Say you've funded your vTrader account and you’re ready to buy your first sliver of Bitcoin. A great starting point for a first-timer is a small, manageable amount—think $50 or $100. This gets you in the game without any real stress.

Market Order vs. Limit Order

When you go to buy, you’ll see two main choices: a market order and a limit order. It’s crucial to know the difference.

- Market Order: This is the "just get it done" option. You’re telling the exchange to buy the crypto right now at whatever the current best price is. It’s fast, simple, and your purchase is practically guaranteed.

- Limit Order: This gives you more control. You set the exact price you're willing to pay. Your order only goes through if Bitcoin’s price drops to your target. It's a great tool, but there’s no guarantee your order will fill if the price never hits your number.

For a first transaction, I almost always recommend sticking with a market order. It's the most straightforward path.

The goal isn't to perfectly time the market—that's a game even pros rarely win. The real win is just executing the trade and seeing how it works. You'll notice a small transaction fee when you confirm the order; that's completely normal for any exchange.

Once you confirm, that’s it! The Bitcoin will show up in your vTrader wallet. You can check out its current price and see your new holding on the Bitcoin (BTC) asset page. Making this first move is a huge confidence booster.

It’s interesting to note that as of 2024, around 40% of American adults now own some form of cryptocurrency. But a recent report on crypto investment statistics highlights that many of these wallets are inactive. This just drives home the importance of starting small, staying engaged, and continuing to learn.

Building Your Beginner Crypto Portfolio

So, you’ve pulled the trigger on your first crypto purchase. What’s next? A single coin doesn't make a portfolio, and this is where many newcomers stumble. The biggest mistake I see is people going all-in on a single, obscure "moonshot" coin they saw hyped up on social media. Frankly, that’s just a recipe for stress and, more often than not, a blown-up account.

A much savvier approach is rooted in diversification. Think of it this way: you wouldn't build a house with just one support beam. Spreading your investment across different digital assets gives you a stronger, more resilient foundation.

Your First Portfolio Structure

For anyone just starting, it’s wise to dedicate the lion's share of your funds—say, 70-80%—to the established market leaders. These are the "blue-chip" assets of the crypto world, the ones with staying power.

- Bitcoin (BTC): As the original and largest cryptocurrency, Bitcoin often dictates the entire market's direction. It's the bellwether.

- Ethereum (ETH): This isn't just a currency; it's the dominant platform for smart contracts and decentralized apps, giving it massive real-world utility.

Market movements often underscore this point. For instance, in Q1 of 2025, Bitcoin’s market dominance swelled to 59.1% of the total crypto market cap. You can dig into more of those trends in the full Q1 2025 report. That single stat shows exactly why a solid allocation to Bitcoin is a cornerstone of any sound beginner strategy.

With your foundation set, the remaining 20-30% of your portfolio is where you can get a bit more adventurous. This slice is for exploring promising altcoins that have a higher risk profile but also potential for higher returns.

Another powerful technique used by seasoned investors is Dollar-Cost Averaging (DCA). Forget trying to time the market—it’s a fool's errand. Instead, you commit to investing a fixed amount at regular intervals, no matter what the price is doing. Think $25 of Bitcoin every Friday, come rain or shine.

This simple discipline smooths out your average buy-in price over the long haul, taking emotion out of the equation and turning volatility into an advantage. It makes investing a calm, steady habit.

Beyond just buying and holding, many investors look for ways to put their assets to work. You can explore ways to earn rewards on your holdings in our guide to crypto staking on vTrader.

Keeping Your Crypto Investments Secure

Watching your portfolio grow is a thrill, but the real mark of a savvy investor is knowing how to protect those gains. Let’s be real—crypto is known for its volatility. Prices can swing wildly, and your greatest asset in those moments isn't a trading tool; it's your mindset. A cool head keeps you from making rash moves, like panic-selling at the bottom of a dip.

But managing risk isn't just about market psychology. It’s about actively securing your assets. This brings us to a fundamental choice every crypto owner faces: where you actually keep your coins.

Hot Wallets vs. Cold Wallets

Think of the wallet you have on an exchange like vTrader as a hot wallet. It's always connected to the internet, making it perfect for quick trades and everyday portfolio management. It's the crypto equivalent of the cash in your pocket—easy to get to and use on the fly.

For your long-term holdings, especially larger amounts, seasoned investors often lean on cold wallets. These are physical hardware devices that keep your crypto completely offline. A cold wallet is like a bank's safe deposit box; it's less about daily access and all about maximum security for your most valuable assets.

Your best bet is a hybrid approach. Use the convenience of your vTrader hot wallet for active trading and smaller balances. For the crypto you plan to hold for the long haul, consider moving it to a dedicated cold wallet.

Steering Clear of Common Scams

Unfortunately, where there’s money, there are scammers. Learning to spot the red flags isn't just a good idea—it's essential. Most scams share a few telltale signs: intense pressure to act now and promises of guaranteed, astronomical returns. Federal regulators are constantly warning investors about these schemes for a reason.

Here are a few common traps to watch out for:

- Phishing Attempts: Be suspicious of any unsolicited email or message asking for your login info or private keys. vTrader will never ask you for your password.

- Fake Giveaways: If you see a celebrity or an exchange on social media offering to double your crypto if you send them some first, it's a scam. 100% of the time.

- Imposter Websites: Always, always double-check that you're on the official

vtrader.iosite before entering your credentials. Scammers build convincing fakes to steal your login details.

Ultimately, your strongest defense is a healthy dose of skepticism. If an offer sounds too good to be true, it absolutely is. Stay vigilant, use smart security practices, and you can protect your crypto with confidence as you navigate the market.

Common Questions from New Crypto Investors

It's completely normal to have a ton of questions, even after you’ve clicked the “buy” button for the first time. Getting into crypto is a learning curve, and nobody has all the answers right away. Let’s tackle some of the big questions we hear from beginners to help clear things up.

One of the first things people ask is about taxes. The short answer? Yes, your crypto profits are almost certainly taxable. In places like the U.S., digital currencies are viewed as property. This means you’ll likely face capital gains tax when you sell, swap, or even use your crypto for a profit. Getting into the habit of tracking every transaction from day one will save you a massive headache later.

How Much Should I Actually Invest?

This is the million-dollar question, isn't it? While there’s no single number that fits everyone, the most important rule is to only invest what you're truly prepared to lose.

For anyone just starting out, putting a small slice of your total investment portfolio into crypto—maybe 1-5%—is a smart move. It gets you in the game and lets you learn the ropes without putting your financial stability on the line.

Treat crypto as the high-risk, high-reward corner of your financial plan. It's not the place for your entire nest egg. Federal regulators constantly point out the market's volatility, so a measured, cautious approach is always your best bet.

A lot of newcomers also worry they’ve "missed the boat." It’s easy to look at past charts and feel that way, but the crypto world is far from finished. New projects, technologies, and opportunities are popping up all the time. Instead of worrying about what could have been, focus on building your knowledge and crafting a solid long-term strategy.

We get into these topics and many more in greater detail. If you've got other questions bubbling up, you can find a lot more answers in the vTrader FAQ section.

Ready to put your knowledge into action? vTrader offers zero-fee trading on Bitcoin, Ethereum, and over 30 other cryptocurrencies, all on a secure, user-friendly platform. Start building your portfolio today.

Steve Gregory is a lawyer in the United States who specializes in licensing for cryptocurrency companies and products. Steve began his career as an attorney in 2015 but made the switch to working in cryptocurrency full time shortly after joining the original team at Gemini Trust Company, an early cryptocurrency exchange based in New York City. Steve then joined CEX.io and was able to launch their regulated US-based cryptocurrency. Steve then went on to become the CEO at currency.com when he ran for four years and was able to lead currency.com to being fully acquired in 2025.