Chainlink in 2025: Still the Oracle King, But the Throne’s Getting Wobbly

It’s 2025. Markets are wild, liquidity is fickle, and the hype cycle never stops spinning. But under all that noise, one thing stays true: bad data wrecks smart contracts. That’s the quiet killer in DeFi. And that’s exactly where Chainlink steps in—or, depending on who you ask, stumbles.

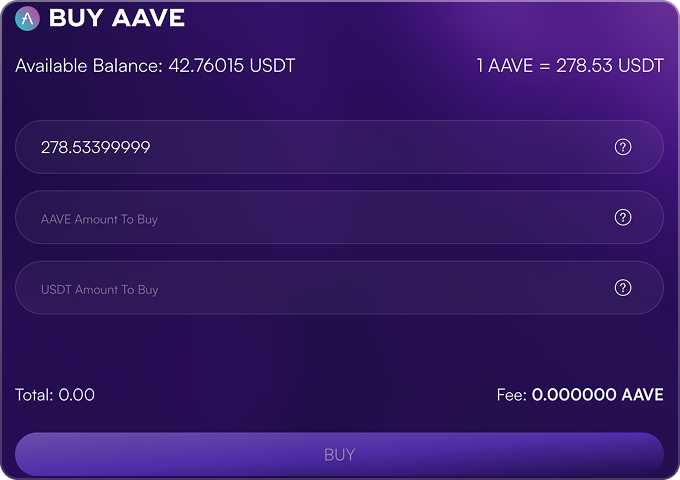

Chainlink (LINK) was built to solve what’s known as “the oracle problem.” Basically: blockchains can’t talk to the real world on their own. They need an interpreter. Chainlink became that interpreter. A decentralized oracle network feeding real-world data—prices, weather, sports scores—into on-chain apps. Since the 2022 FTX collapse nuked trust in anything centralized, Chainlink’s decentralized approach has only looked smarter. As of June 5, 2025, LINK sits at $22.37 with a $14B market cap (CoinGecko). But just because the protocol works doesn’t mean the token’s flawless. Or unchallenged.

What Chainlink Gets Right (and Where It Bites Back)

Chainlink’s edge has always been its network of oracles. Not a single data source. Not a centralized feed that can be manipulated. It spreads the job across a network of independent node operators. Everyone’s got skin in the game. Everyone’s incentivized to stay honest. It’s what saved protocols like Aave and Synthetix from suffering the fate of older systems like Synthetix in 2019, when a faulty oracle led to a massive exploit.

And Chainlink didn’t stop there. Its CCIP (Cross-Chain Interoperability Protocol) is now essential for cross-chain lending and data transfer. Think of it as a tunnel connecting otherwise disconnected blockchains. By mid-2025, over 1,900 projects have integrated Chainlink, a 40% jump year-over-year (Dune). This isn’t some fringe tool. It’s infrastructure.

But let’s talk friction.

Most node operators still lean heavily on centralized services like AWS. Sure, the network itself is decentralized—but the plumbing behind it? Not so much. In 2023, Chainalysis flagged this as a soft spot. If just a few key nodes go dark, billions in DeFi could go sideways. And then there’s cost. Chainlink isn’t cheap. Feeding high-frequency data to your app? That’ll cost you. One dev at ETHDenver joked, “Chainlink works great—until you look at your gas bill and wonder if you accidentally bought dinner for the whole block.”

No major exploits have hit Chainlink since launch. That’s huge. Competitors like Band Protocol can’t say the same—Band was hit with a flash loan attack back in 2022. Still, even with a clean track record, LINK’s price dipped 15% from its May high.

Why? Some say it’s the scalability question. Others point to the tokenomics. Here’s the catch: LINK’s staking system, rolled out in 2022, ties node rewards to token value. If LINK drops too far, node operators make less. And when node operators make less, some leave. That weakens the network. Which could cause more people to sell. See where this is going?

Metrics Tell a Story—But Not a Simple One

On paper, Chainlink’s killing it. It secures $50B in value across protocols as of Q1 2025 (DefiLlama). Pyth, its closest competitor? Just $12B. Band’s further behind at $3B.

LINK’s daily trading volume is holding strong around $400 million. Whale wallets (100K+ LINK) are still stacking, according to Glassnode. But if you zoom in, cracks start to show. Funding rates on Binance and other exchanges turned negative through May, a sign that traders are shorting the token.

Let’s pull up a quick breakdown:

Pyth’s latency is better. That matters for high-frequency use cases like trading. But Chainlink’s reach keeps it at the top. It’s the Bloomberg Terminal of crypto: not the sleekest, not the cheapest, but everywhere.

So why the negative funding?

The data tells two stories—one of strength, one of hesitation. The market loves Chainlink’s dominance but isn’t sold on the sustainability of LINK’s token model.

Chainlink’s Role in What’s Coming Next

Let’s fast-forward a bit.

DeFi’s next era includes real-world assets (RWAs), tokenized everything, and blockchains that talk to each other like they’ve known each other for years. Chainlink is central to all of that. CCIP is already being used to connect Ethereum and Polygon for cross-chain lending. And if projections are even close, the RWA market could hit $10T by 2030 (Boston Consulting Group). Chainlink wants to be the pipes running underneath all that.

But the edge is shrinking.

If Ethereum’s L2s keep slashing gas costs, the price tag on Chainlink updates starts to look bloated. And if someone builds a decentralized oracle that’s faster and 50% cheaper? Builders will switch. Loyalty in Web3 is paper thin.

There are whispers about SupraOracles and others gearing up to compete. If they figure out how to keep latency low and fees even lower? That could pull devs away fast.

Final Thoughts: Strong, But Not Untouchable

Chainlink isn’t some altcoin gimmick. It’s foundational. You pull Chainlink out of the stack, and a huge chunk of DeFi wobbles. But being essential doesn’t mean being invincible.

Centralization at the infrastructure level. Expensive data feeds. Token economics that depend on price action. It’s not a fatal combo—but it’s not bulletproof either.

The market’s sending mixed signals. TVS is climbing. Funding rates say “eh.” Builders love Chainlink, but traders? They’re not sure.

And that’s the tension. Can Chainlink scale without losing what made it trustworthy in the first place?

Time will tell.

Just don’t look away too long—if something does shake the oracle throne, it won’t be a slow fall.