Ethereum Classic in 2025: Holding the Line or Running Out of Time?

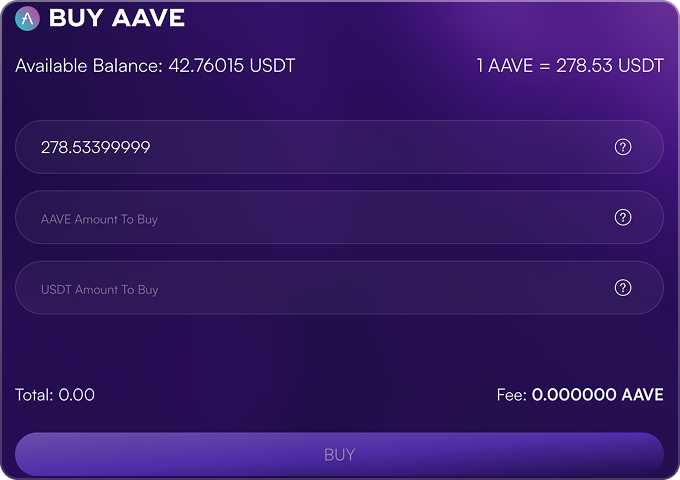

Ethereum Classic (ETC) isn’t trying to win a popularity contest. It’s the chain that stuck to its guns after the 2016 DAO hack. No rollbacks. No rewrites. Just immutability and Proof-of-Work, like it’s always been. That stance earned it some loyalty—and a lot of skepticism. As of June 5, 2025, ETC is trading at $17.37 with a market cap of $2.64B (CoinMarketCap). It’s still alive. Still pushing. But that 41% drop over the past year? It’s not a fluke. Ranked #49 by market cap, ETC’s hanging on while the rest of the market runs ahead. Ethereum’s doing $15B a day in volume. Solana’s at $3B. ETC? Just under $56M.

And yet, people are still watching. Some for the ideology. Others for the Olympia upgrade. A few are betting it’s undervalued. Most just don’t talk about it anymore.

Why Some Still Stick With It

Start with the core: Ethereum Classic hasn’t changed lanes. It’s still PoW. It still treats “code is law” like gospel. Olympia brought EIP-1559 to the table, adding a fee burn mechanism and cutting block rewards to 2.048 ETC. That’s made the token deflationary, which counts for something in a world full of inflation-prone governance tokens. Then there’s USC, ETC’s native stablecoin, and platforms like ETCswap_org. Small stuff, but it proves someone’s still building. There’s also the ETC Nova grants program—funding devs with over 3,399 ETC so far. It’s not massive, but it shows the chain’s not just drifting.

ETC is cheap to use. $0.0004 per transaction. 10–20 transactions per second. No frills, no congestion. Just simple, direct throughput. It’s still attracting some usage: 132 daily active addresses (Etherscan). Nothing wild, but steady. No downtime. No drama. That kind of consistency is rare—even if it doesn’t trend.

But the Market’s Telling a Different Story

Let’s not pretend ETC’s in great shape. It’s 89% off its 2021 high of $165.75. Hasn’t recovered. Hasn’t caught a breakout. It’s not gaining traction, and it’s not leading any narratives.

Ethereum moved on. It’s now PoS, with rollups scaling it to 60,000 TPS. Solana’s playing the speed game. And ETC? Still capped at 20 TPS. In a market where everyone’s chasing performance, ETC’s stuck in the slow lane.

The security argument took a hit too. The 51% attack in 2020 cost millions and left scars. Even if it hasn’t happened again, the memory doesn’t fade. Miners don’t rush to ETC anymore. There’s no incentive when the bigger chains are paying more and attracting more action.

DeFi? Barely there. TVL sits at $50M. Solana has 30x that. Ethereum? 1,000x. Developer activity is minimal. And at Consensus this year, a trader summed it up: “ETC’s a purist chain. But nobody’s building anything that actually scales on it.”

Technicals don’t help. RSI at 44. MACD leaning bearish. Some are calling for a drop to $16.50. Others, like CoinPedia, see a rebound to $55 by year-end. Depends on your tolerance for pain.

By the Numbers

150M ETC is in circulation out of a max supply of 210.7M. The tokenomics are tight, but the market’s not biting. Funding rates on Binance are negative. Whale wallets haven’t made moves. Nobody’s betting big.

The dev ecosystem is thin. About 200 dApps live on ETC. Compare that to Ethereum—thousands. And the market cap to TVL ratio? 8,038. That’s not sustainable. Most of the capital is speculative, not locked.

Still, you’ve got some voices on X—@WHALES_CRYPTOzz, for example—calling for $35 if ETC clears resistance at $19.50. It’s possible. Just not probable without a shift in the narrative.

What’s Left for ETC to Prove?

Olympia was a step in the right direction. Fee burns are a solid mechanic. The native stablecoin helps. But that’s not enough to carry the chain into the next cycle unless something bigger shifts. If the market swings back toward PoW as the “secure” alternative to PoS? ETC could ride that. If DeFi builders decide to spread risk and deploy across multiple chains, ETC’s low fees might draw some attention. That’s a long shot, but not impossible.

Black swan risk is real, though. Another 51% attack would be devastating. And if regulators crack down on PoW chains—especially those without strong KYC controls—ETC’s on that list.

CoinLore says $136.84 if things break right. WalletInvestor? $15.54. TradingBeast even floated $0. Zero. All over the place.

It’s binary. If ETC finds a new lane, it might 5x. If it doesn’t, it slowly bleeds out. No middle ground.

Final Thoughts: It’s Still Standing, But for How Long?

Ethereum Classic is a product of conviction. It didn’t bend during the DAO mess. It didn’t follow the rest of the ecosystem into PoS. That matters to some people. And the Olympia upgrade proved the chain can still evolve—just slowly, and on its own terms. But this space isn’t known for patience.

ETC doesn’t have the scale. It doesn’t have the devs. It doesn’t have the volume. The people who believe in it do so because of what it stands for—not because of what it does.

And that’s the gamble. You’re either betting that principles will eventually matter again—or that the market always chases what’s fastest, cheapest, loudest. Either way, ETC isn’t changing for anyone.

Whether that’s brave or foolish… depends on how this next cycle plays out.